In the face of increasing volatility in global energy and commodity markets and growing uncertainty in the macro-financial environment, commodity trading enterprises are encountering unprecedented risk challenges. To cope with these challenges, more and more companies are turning to financial derivatives for risk management. Their aim is to hedge against price volatility, stabilize cash flow, and optimize the structure of their balance sheets.

However, in the actual operation of hedging transactions using financial derivatives, enterprises encounter a range of difficulties. These challenges not only reduce the efficiency and accuracy of trade management but also raise compliance and market risks. The key pain points are as follows:

- Complex and inefficient data management for derivative trades: These transactions generate massive data from scattered sources. Manual input is slow and prone to errors, creating serious challenges for trade management.

- Fragmented hedging processes: Many enterprises lack a systematic process for managing hedging strategies. Gaps exist in approval, execution, and monitoring, often leading to the issue of “trade first, plan later,” significantly increasing compliance risks.

- Poor data flow across trade stages: Execution, P&L calculation, and settlement are fragmented. This causes data handoff issues and errors that can impact financial management and risk control.

- Lack of integrated view for physical and paper trades: The relationship between derivatives and physical goods is complex. Enterprises often lack a combined management perspective, making it hard to monitor real exposure and weakening their ability to manage market risk.

To address these pain points, this article presents Fusion’s systematic solutions and case studies of customized implementation, helping enterprises enhance the management of hedging trades and improve risk control for stable business operations.

I. The Solution: Fusion’s Systematic Management Model

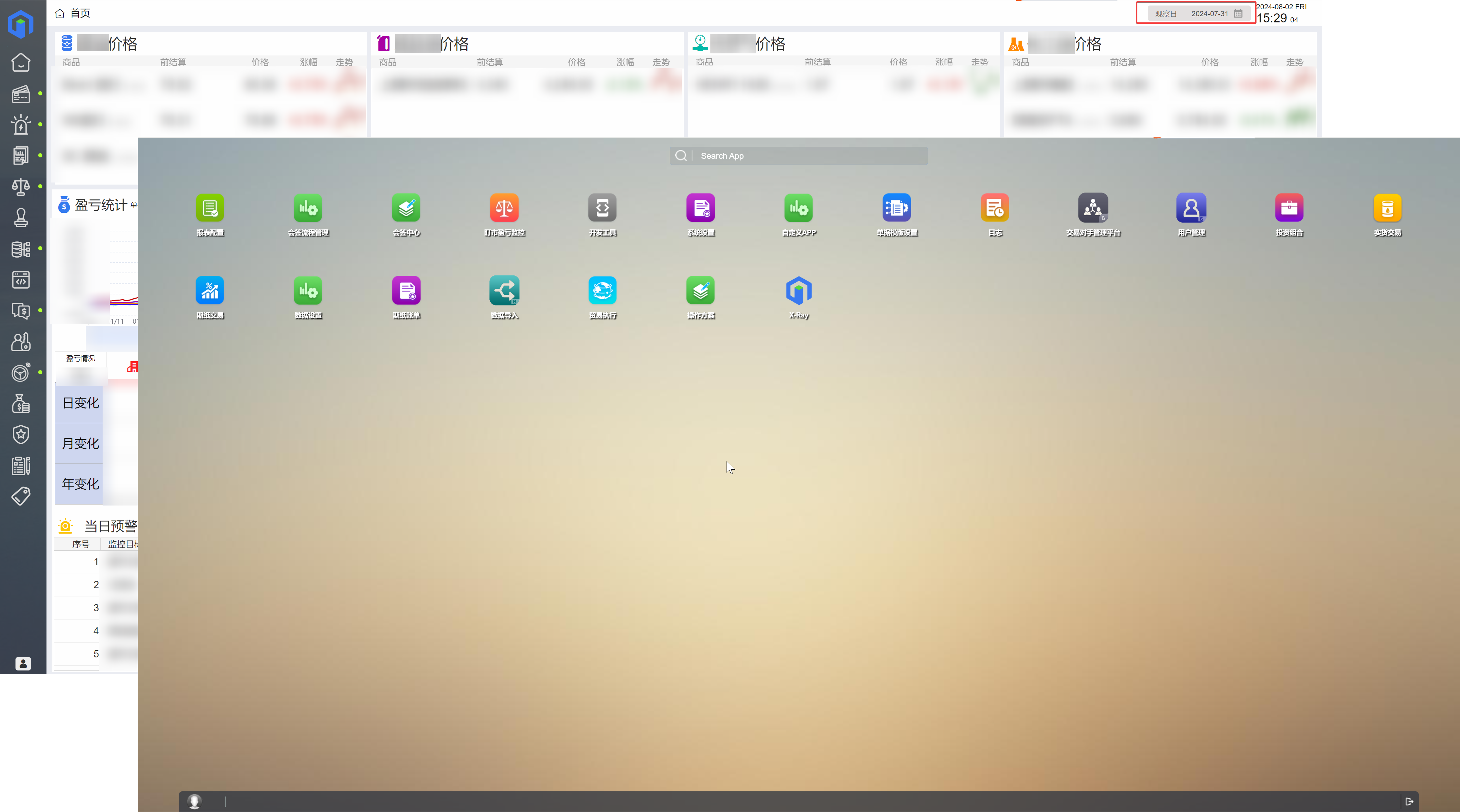

Fusion offers a systematic management framework that covers derivative trading, master data management, portfolio management, and hedging operation strategies.

1. Derivative Trading

Fusion supports financial derivative transactions related to hedging in energy and other bulk commodities. It covers both commodity and financial derivatives.

For commodities, it supports trading of crude oil, refined products, natural gas, etc., across global benchmarks such as BRENT and WTI, with hundreds of listed and OTC derivatives across various time zones.

For financial derivatives, it supports index futures, currency futures, and FX swaps.

Supported contract types include futures, swaps, and options.

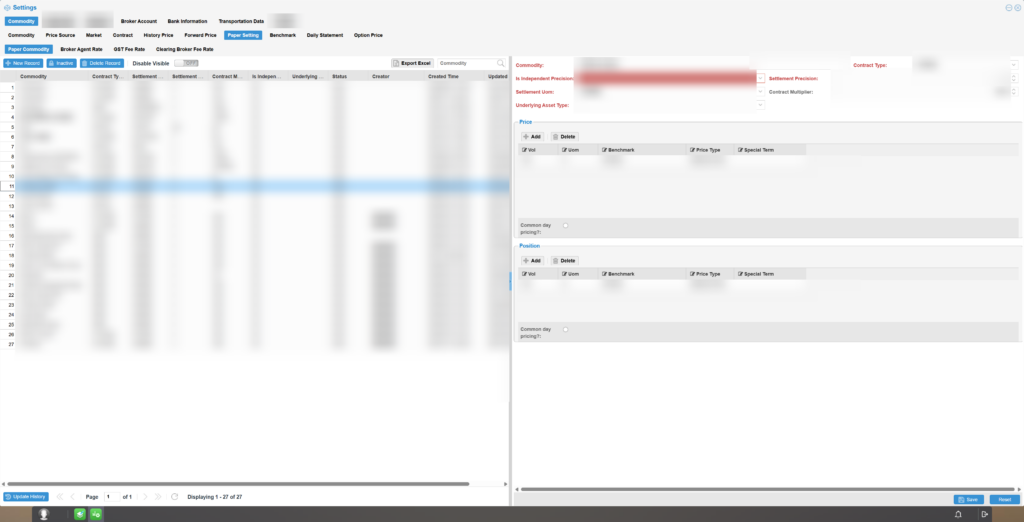

2. Master Data Management

Fusion manages core information needed for derivative trading: commodities, price sources, markets, contracts, benchmarks, derivative types, conversion rates, holidays, and monthly average exchange rates.

By centralizing the management of these data, Fusion ensures accuracy and consistency, improving trade management efficiency.

3. Portfolio Management

Fusion uses a tree-structured portfolio approach to categorize and manage different types of trades, including physical goods, derivatives, and inventory.

This allows for flexible grouping and classification, while also enabling calculation of P&L and positions at each level. The structure serves as a statistical dimension for various data sets.

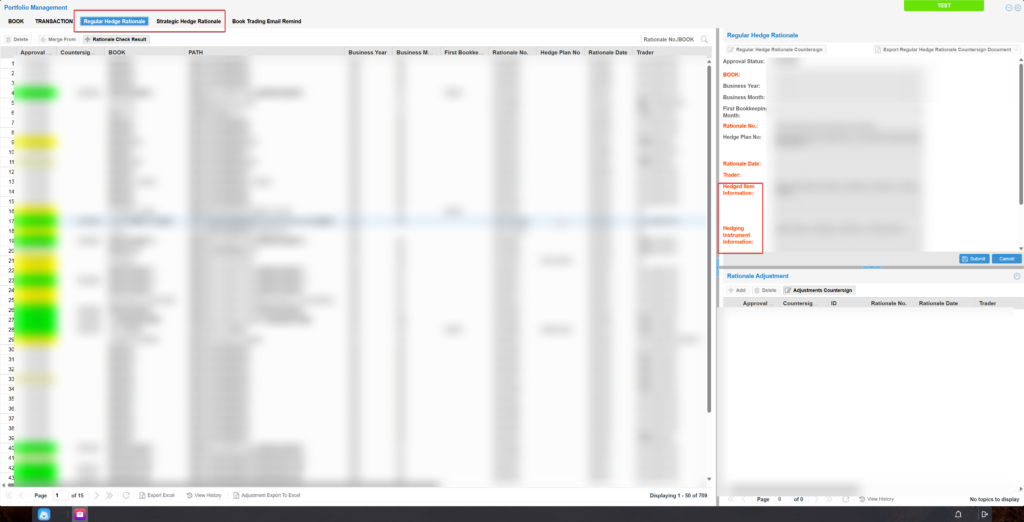

4. Hedging Operation Strategies

Fusion provides effective management of hedging strategies. It supports both basic and strategic hedging, allowing companies to choose classification methods based on their business and regulatory needs.

It enables the effective matching and querying of physical and derivative transactions. This facilitates position and P&L calculation and simplifies the assessment of hedging effectiveness.

Fusion supports the full lifecycle: input, adjustment, approval, review, and evaluation. Strict control of hedging strategies and related processes helps reduce unauthorized trades.

To simplify operations, users can classify strategies by business type and create reusable templates. These templates can be fine-tuned during entry, improving input efficiency and helping retain hedging know-how.

5. Automated Trade Management

Fusion automates the entire trade management process, including entry, validation, broker reconciliation, P&L and position calculation, and settlement. This includes:

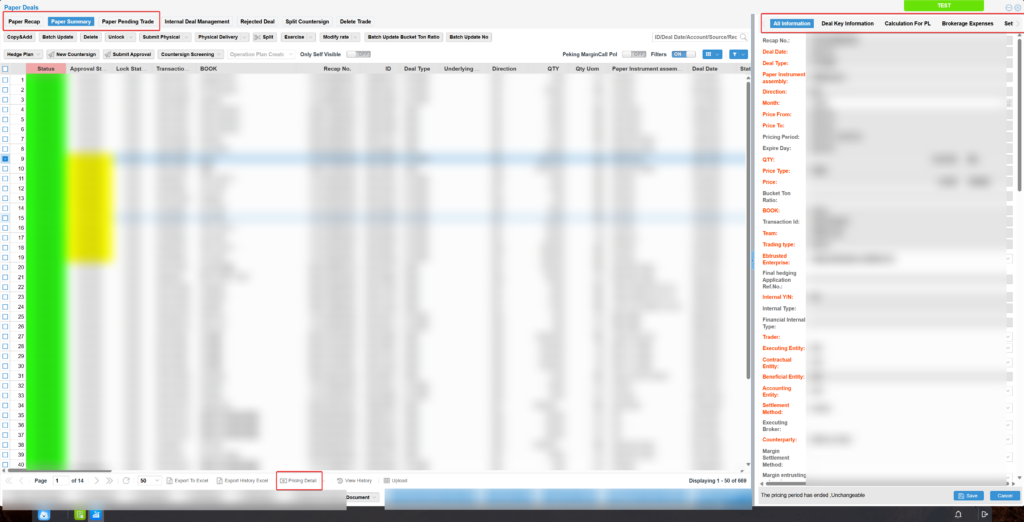

(1) Derivative Trade Management

Fusion manages core trade information and brokerage fees. It supports real-time input, batch import, and manual uploads.

For exchange trades, it integrates with exchanges like ICE and CME for real-time data capture. For commonly used platforms, it supports parsing and importing reports from ICE, ATP, CME, CQG, etc. Manual entry is also available to meet diverse needs, improving efficiency and timeliness.

Additional features include search, edit, copy, split, approval, lock, and export of trades. It also supports pricing details, business forms, and document management as needed.

(2) Data Validation and Confirmation

Fusion validates and confirms entered trades. It automatically or manually parses broker statements and matches them with system trades, either automatically or manually.

Users can view statement details for both listed and OTC trades to track margin, P&L, and fund changes.

(3) Mark-to-Market (MTM) P&L Calculation

Fusion provides MTM functionality. Users can view current positions and P&L for relevant derivatives in the MTM module.

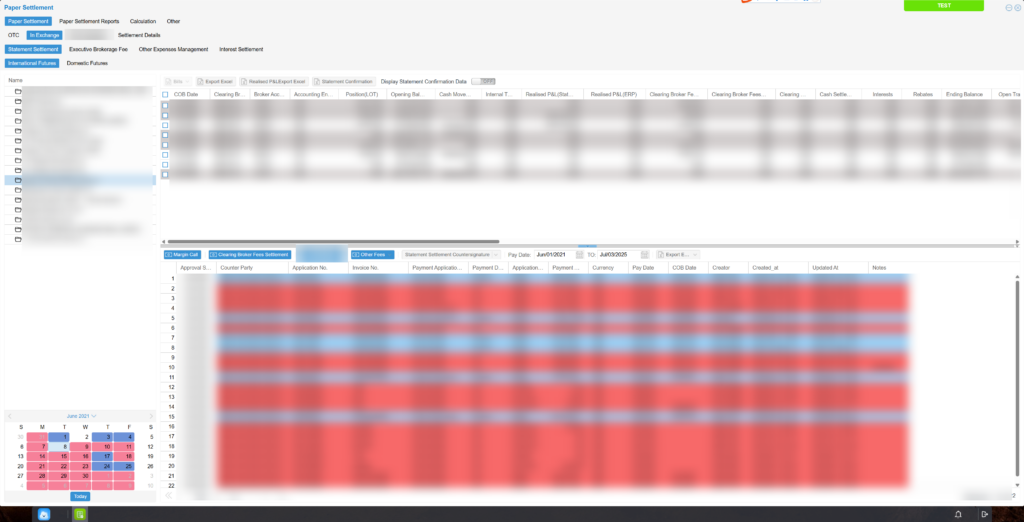

(4) Settlement Management

Fusion handles all settlement-related operations for derivative trades, including data entry, reconciliation, approval initiation, and submission for finance approval. It also tracks finance approval and payment status.

It covers both OTC and listed markets. OTC settlements include P&L, margin, interest, and commission. Listed settlements include international and domestic futures, brokerage fees, interest, and other costs.

With automated data collection and strict process control, Fusion achieves end-to-end automation of derivative data flow. This enhances timeliness, accuracy, consistency, and overall trade management efficiency.

6. Data Integration and Customization

Fusion’s data integration design allows different data to interact based on the scenario. For example, option-related fields only appear during option trades. For other trades, these fields are hidden. Selecting certain codes triggers related data to auto-fill, reducing manual input.Cross-module data linkage ensures consistency.

The system also allows users to define default field values. Basic data tables are configurable and extensible. This enables companies to tailor default values to fit their unique business needs, supporting personalized management.

Through its unified yet flexible functions—including integration, modular design, master data control, portfolio management, and customizable settings—Fusion breaks down barriers between product lines and business models. It provides unified management and multi-dimensional analysis of derivative trading data.

Fusion helps enterprises shift from manual to automated and unified trade management, reducing operational costs. It also optimizes hedging rules and processes, enabling early-stage risk prevention and maximizing the risk-control potential of financial derivatives.

II. Case Studies: Combining Systematic Solutions with Customized Implementation

While offering systematic solutions to address industry pain points, Fusion also takes into account the unique management needs of individual enterprises.

This section presents three companies—H Company (a large international oil trading company), A Company (a specialized international oil company), and B Company (an independent oil trading firm)—to demonstrate how Fusion satisfies both common and customized management requirements. The details are explained below.

Pain Point 1: Derivative trade data is complex, sources are fragmented, manual input is inefficient and error-prone

Implementation Plan

Common Features:

- Provides a unified master data management mechanism for derivative types, price sources, and benchmarks to ensure consistency across the system.

- Supports direct connectivity with exchanges (e.g., ICE, CME) and parsing of commonly used reports (e.g., CQG, ATP). Enables automatic and batch data entry while allowing manual supplements to ensure completeness.

- Automatically parses broker statements and matches them with system trades to improve trade accuracy and reduce manual errors.

- Applies data linkage and default value settings for key fields to minimize repetitive actions and enhance efficiency.

Customized Features:

- H Company, A Company, and B Company customized their master data (e.g., products, derivative types, price sources) based on their business characteristics.

- Trade input methods were tailored to commonly used exchanges and platforms. For example, B Company focuses more on direct connections with ICE and CME, while H and A Companies have different preferences.

- Parsing needs for broker statements vary across the three companies. Fusion meets these personalized requirements to improve parsing efficiency and accuracy.

- Data linkage and default value configurations were adjusted based on business needs. For example, if a company doesn’t trade options, the dropdown list for derivative types will not display them.

Result:

With unified master data and automated trade management, the average trade input efficiency for H, A, and B Companies improved by 60%. Manual input errors dropped by over 70%, effectively resolving challenges related to data complexity and high error rates.

Pain Point 2: Lack of a systematic hedging process; gaps in approval, execution, and monitoring lead to “trading first, planning later”

Implementation Plan

Common Features:

- Introduces a strategy management module that supports classification between basic and strategic hedging.

- Establishes a closed-loop process covering strategy entry, approval, execution, and evaluation, strengthening control and ensuring compliance.

- Provides strategy template management to improve preparation efficiency and encourage knowledge retention.

Customized Features:

- H, A, and B Companies adopted different hedging management strategies based on their business needs and regulatory requirements. For example, H Company focuses on distinguishing between basic and strategic hedging, while A and B Companies follow other classification methods.

- Each company configured its own approval steps and execution criteria to ensure strategy compliance and effectiveness. For example, H Company does not allow trade input until the strategy is fully approved, reducing unauthorized trades.

- In A Company’s case, Fusion also provided strategy template management, improving input efficiency and helping the company consolidate its hedging expertise.

Result:

After implementing classified and closed-loop strategy management, hedging strategy approval efficiency increased by over 40% on average across the three companies. Unauthorized trades were significantly reduced, addressing issues related to fragmented processes and compliance risks.

Pain Point 3: Trade execution, P&L calculation, and settlement are scattered; data flow is inconsistent and error-prone

Implementation Plan

Common Features:

- Establishes a complete automated trade management chain, covering trade input, reconciliation, confirmation, MTM calculation, and settlement.

- Enables automatic P&L and position calculation with multi-dimensional display to improve financial control and risk management.

- Facilitates automatic data transmission between modules—such as trade, cost, and P&L data—ensuring smooth and accurate data flow.

Customized Features:

- The three companies implemented the automation chain differently. Some focused more on integration with financial systems, while others prioritized real-time and accurate trade data.

- Each company configured different statistical dimensions and display methods for P&L and position data based on business needs.

- Data linkage requirements also varied. For example, H Company required automatic transfer of key data to the settlement module to improve settlement speed and accuracy.

Result:

Through automation and data linkage, the average trade processing efficiency of the three companies improved by about 50%, resolving problems caused by fragmented execution stages and inconsistent data flow.

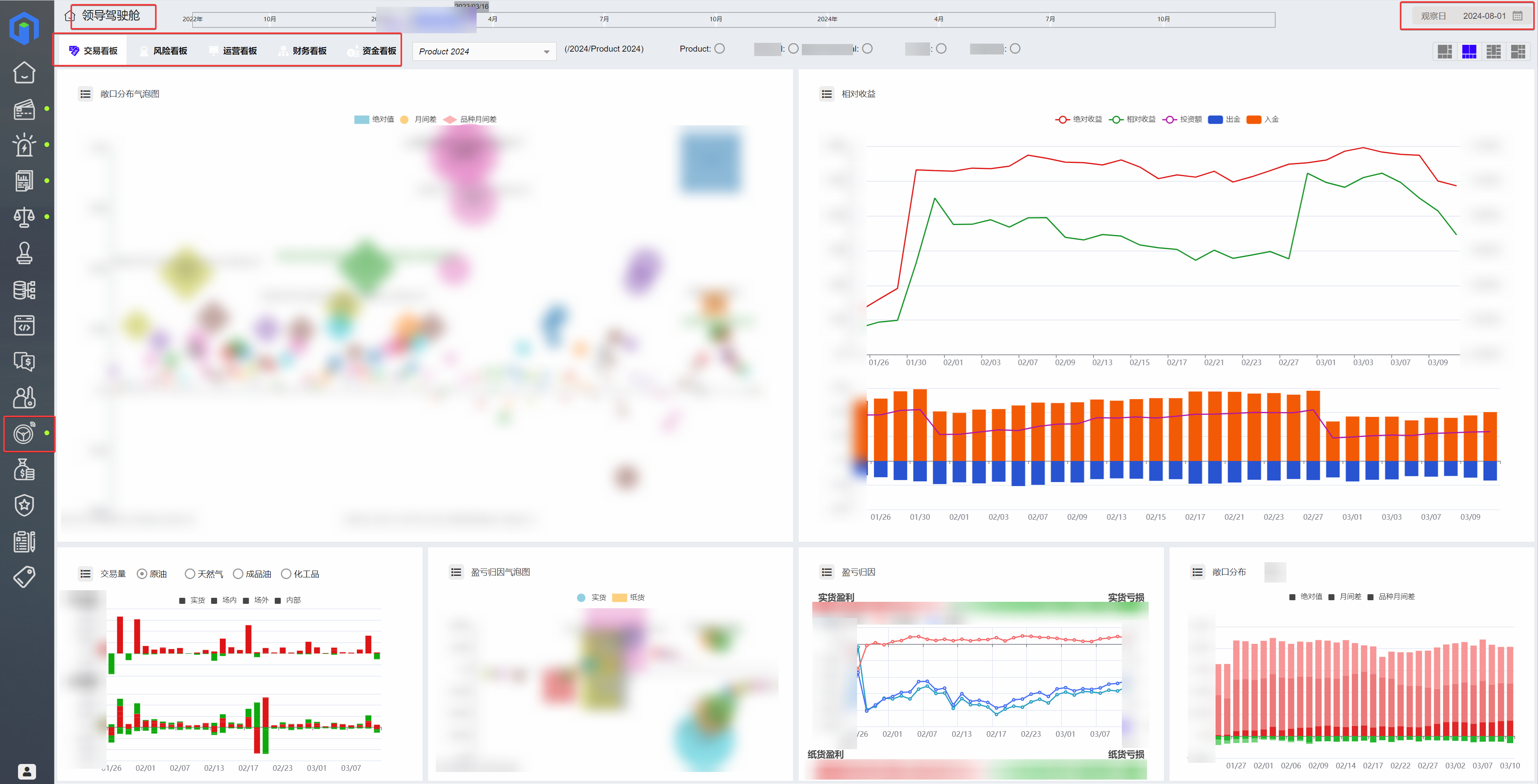

Pain Point 4: Complex relationships between physical and paper trades; lack of a unified portfolio view makes it hard to monitor real exposures

Implementation Plan

Common Features:

- Introduces a tree-structured Portfolio system to manage physical trades, derivatives, and inventory within a single framework, enabling a combined management view.

- Links portfolios with hedging strategies to facilitate effective matching between physical and derivative positions. This also provides data support for evaluating hedging effectiveness.

Customized Features:

- Application of the tree-structured portfolio differed among companies. Some required inventory management and MTM functionality, while others did not.

- Matching rules and evaluation criteria for physical and derivative trades were customized based on each company’s business needs.

Result:

By linking portfolios with hedging strategies, the three companies achieved an average matching rate of over 80% between physical and paper positions. This enabled daily exposure monitoring and assessment of hedging performance, solving the problem of managing complex physical-derivative relationships.

Conclusion: Building a Systematic Model for Derivatives Trade Management

By combining systematic solutions with customized implementation paths, Fusion has helped multiple commodity trading firms streamline key processes for managing financial derivatives.

From unified master data and automated trade processing to closed-loop strategy management and portfolio exposure tracking, Fusion enhances companies’ capabilities in efficiency, compliance, and risk control.

Practice shows that a derivatives trading system must not only cover complete business workflows but also support personalized management models and risk requirements.

Fusion, with its modular architecture and data linkage design, offers a replicable and scalable model for trade management. It helps enterprises operate steadily and respond flexibly to risks in a volatile market environment.