From professional trading and risk management tools to an all-in-one process execution platform

Early Fusion System was a typical ETRM/CTRM system, primarily designed to serve commodity trading companies and financial institutions. It was a highly specialized trading management and risk management tool. In the trade and finance industry, collaboration and risk management are crucial, and Fusion provides a comprehensive solution for these needs.

Over time, we have continuously improved and updated Fusion to better adapt to the diverse needs of users. To date, Fusion has evolved into a lightweight, modular all-in-one business management and process execution platform, capable of meeting the requirements of large-scale trading enterprises and even small to medium-sized businesses.

Fusion not only boasts rich functionalities but also high integration and user-friendliness, making it adaptable to rapidly changing business environments. Whether you need professional trading and risk management tools or want to enhance daily management efficiency, Fusion can provide you with the right solutions.

Therefore, when discussing Fusion , we need to focus on two aspects: its functions and advantages as a professional trading tool and its versatility and flexibility as an all-in-one business management platform.

We believe that, regardless of your business requirements, Fusion can offer you the most suitable solutions.

From simple transactions to complex trades: Addressing financial challenges

Trade transactions differ from traditional buying and selling; they often involve financial attributes. What does this mean?

In simple buying and selling, the focus is on ownership of goods, and prices are fixed. However, in trade, we may be concerned not only with the items themselves but also with many other rights containing financial characteristics, including pricing rights and buying and selling rights. Additionally, the price of a single transaction may change over time, and the valuation methods for inventory are different from traditional trade industry valuation methods.

The virtual nature and uncertainty introduced by these factors make trade more complex and pose new challenges. One of the major challenges is risk management: how to protect our investments when prices fluctuate. It’s important to note that the uncertainty and profit impact of complex trades in the trade sector, including factors such as significant price fluctuations in the underlying assets and an increase in risk factors, far surpass those of traditional transactions.

Simultaneously, we also need to address specific issues in trade, such as how to accurately and quickly record large volumes of transaction information, especially in financial transactions such as hedging futures and options that occur in rapidly changing financial derivative markets. Effectively categorizing and organizing this information, integrating it with physical trading, quantifying trade risks collaboratively, and formulating hedging strategies to reduce risks are essential. Physical trade involves various logistics and execution modes, such as sea and road transport, with completely different collaborative methods. To coordinate the cooperation process between partners, a significant amount of industry knowledge needs to be integrated into the system.

These are the problems that Fusion is committed to solving. Through our system, you can more easily manage your trade transactions, reduce risks, and improve efficiency.

Cracking the trade puzzle: No need to reinvent the wheel

Let’s liken the process of managing business to accounting. Before double-entry bookkeeping became widely adopted, single-entry bookkeeping was the mainstream in various industries. Similarly, before CTRM/ETRM software was defined, many businesses used traditional ERP software to manage trade and financial hedging activities. Compared to double-entry bookkeeping, single-entry bookkeeping, or what we call “cash book” accounting, lacked clearly defined accounts and debit-credit checks, with no unified report generation method. However, the introduction of double-entry bookkeeping, like CTRM/ETRM software, brought a completely new solution to the world of trade. This new solution is more adaptable to the true nature of business, better able to depict and manage it.

Operating trade and risk management businesses using TRM software is like using a wheel that has been tested and proven over a long period. In contrast, managing these businesses using traditional methods is akin to using a square wheel. Using manual spreadsheets is like attempting to reinvent the wheel. The CTRM/ETRM features of Fusion provide a complete, mature system that includes all the tools and methods needed to handle trade transactions. With the help of Fusion , our clients can focus more on their business without worrying about the intricate details.

Not just theory, but also practice

Understanding theory alone does not guarantee success in the trade or financial fields, just as a military force cannot win solely by understanding military theory. Based on a foundation of correct theory, the key to success lies in being able to identify and evaluate opportunities and repeatedly execute effective strategies. This requires a mechanism and system that can motivate every aspect of a business to operate this set of operations effectively.

Fusion not only includes comprehensive theory but also provides a complete environment for practical operation. This real and usable environment brings long-term value to clients, allowing them to not only keep their business running but also passively develop habits over the long term, considering multiple factors and comprehensively evaluating operational effectiveness. For example, besides profitability, the system silently trains businesses to involuntarily consider the costs and risks incurred in pursuing profits, including already paid costs. This is a cognitive revolution, and long-term use of chaotic and impractical ERP systems and manual spreadsheet systems can never bring about this level of cognitive upgrade and habit change. Therefore, Fusion brings about a unity of knowledge and action.

Clearly, as a TRM application, Fusion helps users break through chaotic perceptions, improve business collaboration and execution efficiency, avoid the “precise error” of pursuing profit unilaterally, and assess fuzzy opportunities while preventing and managing potential risks.

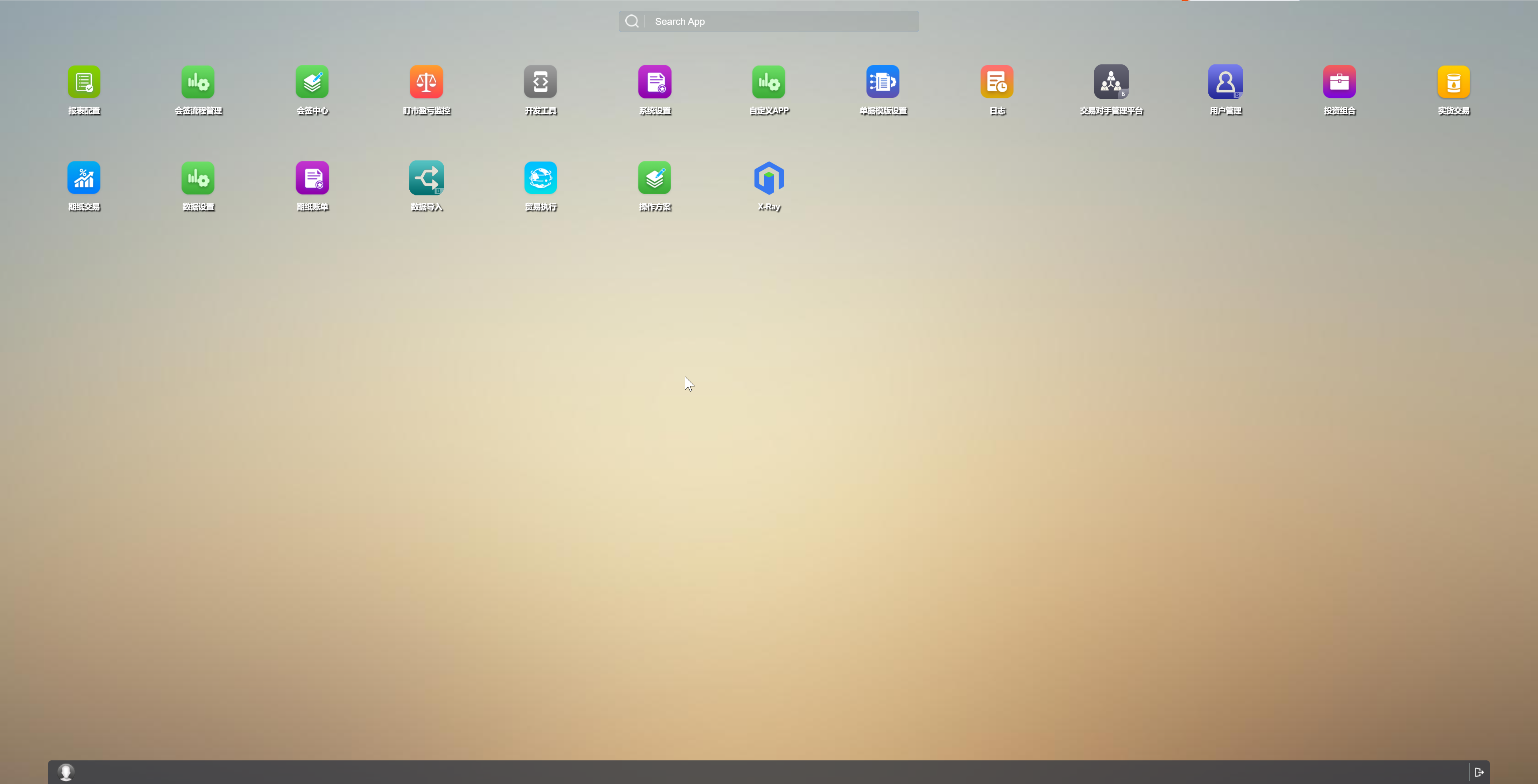

Not just TRM, but also a broad-spectrum industry process execution management tool

Fusion not only meets the needs of the target industry for TRM but also includes a range of features in its infrastructure and latest versions. Apart from a set of user-friendly and powerful permissions, organizational management, data visibility management, and process management engines, it also incorporates features such as human resource management, performance calculation, career development, goal setting and tracking, and KPIs for organizations at various levels. The core philosophy of the new generation Fusion system is to inherit the excellent design of traditional TRM and further reduce the learning curve, making it more in line with actual business needs. It measures and observes performance not just from financial standards but also from a business perspective.

Regardless of the size of the enterprise, the fundamental elements that Fusion focuses on include the execution efficiency of the profit model, identification and control of risks, long-term growth shaping, and continuous improvement of team combat effectiveness. Therefore, the new generation Fusion system is a more flat, directly focused on the essence of the enterprise, practical, and user-friendly lightweight enterprise system. This new solution can be widely adapted to different industries, providing comprehensive business management functionalities.