In the globalized environment, commodity trading companies face increasingly complex trading situations and risk management challenges. For instance, traders like Li Ming and risk control personnel such as Liu Hua working in a commodity trading company need precise management and analysis of trading data, with real-time monitoring of P&L changes being a core focus for effective risk control.

This is precisely where Fusion’s Mark-to-Market P&L module excels.

Fusion’s Mark-to-Market P&L module is a specialized business data analysis and risk control auxiliary tool designed for commodity trading companies. Its introduction is akin to a sharp Swiss army knife, addressing pain points in the trading and risk control processes for individuals like Li Ming and Liu Hua.

Insightful P&L Analysis: The Intelligent Trading Perspective of the Mark-to-Market P&L Module

For example, during a bulk commodity trade, Li Ming needs to examine the position and P&L status of relevant trades. He opts for the query function (position) in Fusion’s Mark-to-Market P&L module. By selecting parameters such as trade date, calculation type, price type, etc., he swiftly retrieves the required position table, P&L table, and corresponding P&L change analysis data.

Moreover, these data can be presented in different forms and types to cater to Li Ming’s varying needs for exposure and P&L examination and analysis. Here, the multidimensional slicing and perspective analysis features of the Mark-to-Market P&L module play a crucial role, providing Li Ming with a comprehensive tool to deeply analyze trading data from multiple angles and make informed decisions.

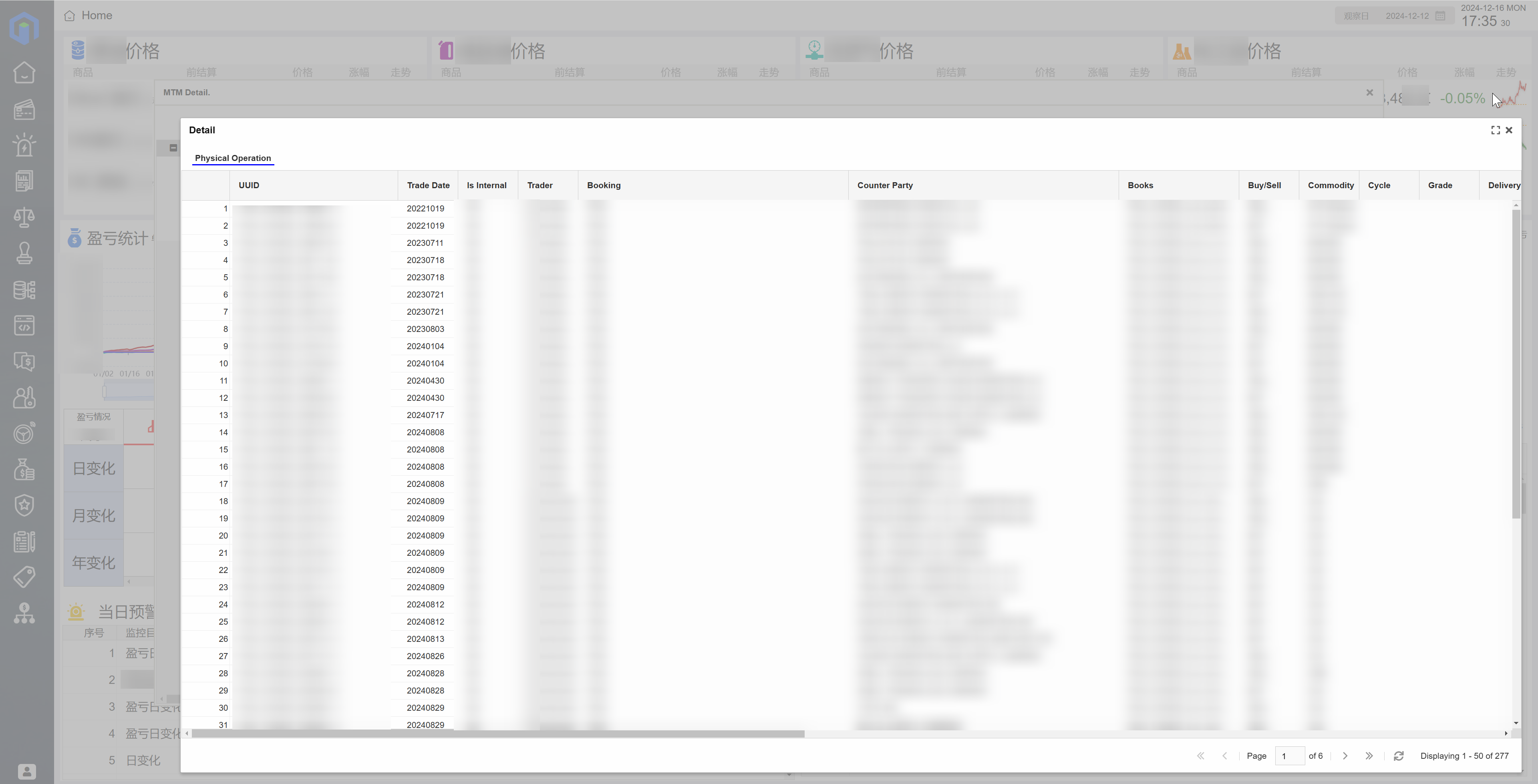

These data not only can be displayed on the screen but also support export, facilitating further analysis and utilization by Li Ming. Digging deeper into the data table, Li Ming can also see position/P&L details, including futures and paper details, physical inventory details, and P&L reason trade details. This detailed information allows Li Ming to gain an in-depth understanding of P&L changes and specific reasons, providing more accurate data support for his decision-making.

Furthermore, while using Fusion’s Mark-to-Market P&L module, Li Ming discovers its feature of multiple price data source interfaces. This means he can obtain price information from different sources, ensuring diversity and accuracy in price data. This additional flexibility and accuracy significantly enhance his work efficiency when acquiring price data.

In another trade scenario, Li Ming needs to calculate the exposure and P&L of a specific hierarchical trade. He utilizes the calculation feature of Fusion’s Mark-to-Market P&L module, selecting a specific trade category for calculation. Once the calculation results are available, he finds the needed data in the query function (position). This way, Li Ming can perform exposure and P&L calculations flexibly and accurately based on actual needs.

Here, the Mark-to-Market P&L module’s feature of using multiple sets of forward prices to calculate exposure P&L comes into play. This means Li Ming can use different types of forward prices to calculate exposure P&L, providing him with higher flexibility and adaptability.

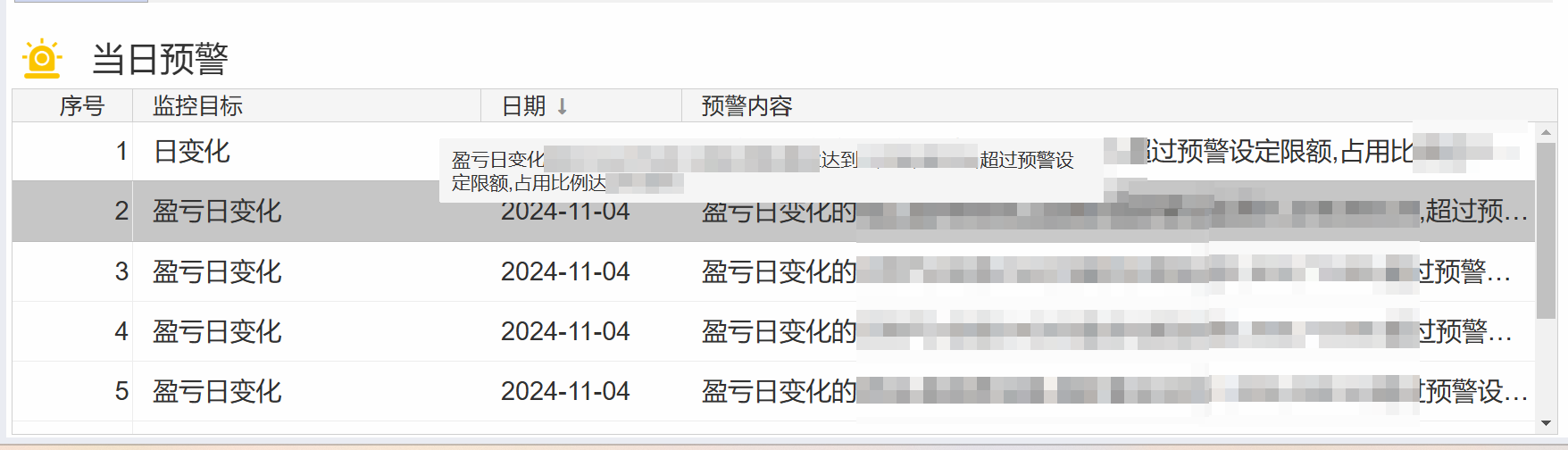

Precision Risk Control: The Data Magic of the Mark-to-Market P&L Module

For risk control personnel like Liu Hua, during a risk control process, he notices that the valuation period of an expired marked-to-market price variety needs modification. He selects the Mark-to-Market P&L module’s expired MTM valuation function to make the necessary adjustments. This ensures the accuracy of price calculations, avoiding P&L calculation errors due to valuation mistakes.

In another risk control scenario, Liu Hua needs to obtain summarized data on historical and forward prices. He chooses the risk control data summary function of the Mark-to-Market P&L module, downloading detailed data information corresponding to the respective price situations.

Simultaneously, he requires detailed transaction information. Conveniently, the risk control mark-to-market function consolidates transaction detail data, including overviews, basic information, transportation information, price information (including valuation formulas, mark-to-market formulas, risk control formulas), payment and credit terms, and other details. This makes it easy for Liu Hua to perform mark-to-market analysis without the need to search for various transaction information elsewhere, and allows for modification of transaction information as needed.

Fusion’s Mark-to-Market P&L module provides commodity trading companies with a comprehensive tool for business data management and risk control, effectively enhancing business efficiency and decision accuracy. Whether Li Ming is seeking higher efficiency in trading or Liu Hua is pursuing greater precision in risk control, Fusion’s Mark-to-Market P&L module proves to be a valuable assistant.

In this data-driven era, having precise, real-time, and comprehensive data analysis and risk control tools is essential for every commodity trading company. Fusion’s Mark-to-Market P&L module serves as such a tool. Its presence simplifies and streamlines data management and risk control in commodity trading, placing every trade under the control of individuals like Li Ming and Liu Hua.