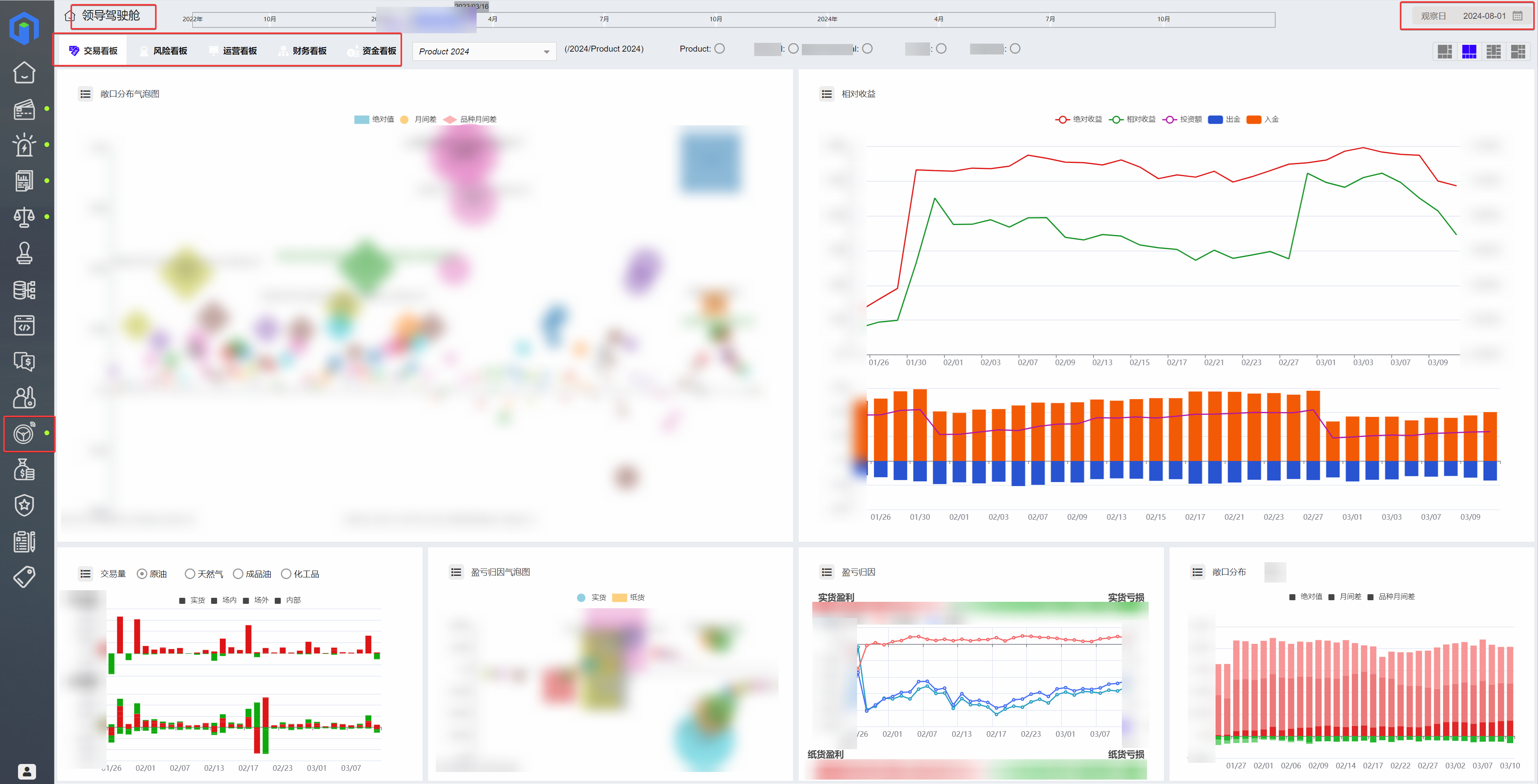

UNIPEC, the trading division of Sinopec, is a massive international crude oil trader that provides raw material supply for Sinopec Group, undertaking half of China’s crude oil import business. To integrate business and finance and improve operational efficiency and management level, UNIPEC has introduced the Fusion system by Galaxies Graph (盈和网联) as its sole comprehensive execution and operation platform. The Fusion system covers all aspects of UNIPEC’s full business lifecycle, achieving integrated business, finance, and risk management.

UNIPEC has numerous overseas companies and also features characteristics of a large state-owned enterprise. To meet the diversity and complexity of UNIPEC’s business, the Fusion system provides multiple modules, including physical trade entry, physical trade execution, physical inventory management, portfolio management, mark-to-market profit and loss management, mark-to-market exposure management, physical settlement, futures settlement, financial system interface, fund management, contract countersign management, risk cargo value, financial interface (SAP), and more.

UNIPEC’s large branches include Beijing Headquarters, Asian Company, UK Company, US Company, and Singapore Company. The implementation of the Fusion system took about three years and was fully launched and used in 2021. Through the use of the Fusion system, UNIPEC successfully integrated business and finance, improved operational efficiency and management level, laying a solid foundation for the company’s sustainable development.

The implementation of the Fusion system has brought tremendous help to UNIPEC. First, it has improved work efficiency. Through the integration of physical and futures entry, execution, mark-to-market, settlement, etc., the Fusion system has achieved seamless connection between the front and back ends of the business, reduced manual intervention by business personnel, and greatly improved work efficiency. According to UNIPEC staff, the business process can save 40%-60% of time after the implementation of the Fusion system, greatly shortening the business processing cycle and improving business response speed.

Secondly, the accuracy of the Fusion system is very high. The system can significantly reduce human errors through automated calculation and verification. In addition, the system supports multiple pricing modes, such as per-transaction settlement and weighted average settlement, adapting to different business scenarios and improving pricing accuracy. By using the Fusion system, UNIPEC can comprehensively monitor and analyze business data, promptly detect and correct errors, ensuring the accuracy of business processing.

Finally, the Fusion system can help UNIPEC reduce costs and increase benefits. The system’s automated processing function can reduce manual intervention and lower the cost of business processing. Through the system’s data analysis and risk control functions, business risks can be effectively reduced, and efficiency can be improved. By using the Fusion system, UNIPEC can better control business costs and improve corporate profitability.

In summary, the implementation of the Fusion system has brought tremendous help to UNIPEC, improved work efficiency, ensured business accuracy, reduced costs, and increased benefits. With this system, UNIPEC has successfully made the leap from being known as the “number one buyer of crude oil” to becoming a global giant in crude oil trading.