In today’s rapidly changing global energy market, digital transformation has become key for large enterprises to maintain competitiveness. This article reveals how one of the world’s top five oil trading companies, Company H, has achieved perfect integration of business, finance, and risk control through the cutting-edge Fusion system, distinguishing itself in the intense market competition.

Company H is a major oil trading company with an annual revenue exceeding $150 billion, operating in over 60 countries and regions worldwide. Its business scope covers international energy trading, including oil and natural gas. As an industry leader, Company H has always been dedicated to optimizing global energy supply and demand, creating value for its supply chain clients through efficient trading activities, and has a strong reputation in the industry.

However, in 2018, even this industry giant faced severe management challenges:

-

- Lagging Risk Management: Company H was struggling with outdated risk management practices. The risk control department could only rely on delayed data for analysis, making it impossible to monitor and assess risks in real-time. This issue led to a $230 million “black swan” event in 2018, severely impacting the company’s financial status and market confidence.

-

- Complex Internal Management: With over 20 subsidiaries and 10 core management departments spread across the globe, the complex organizational structure led to communication difficulties between departments and inefficient process flows. On average, cross-departmental decisions took 7-10 working days to complete, severely affecting operational efficiency.

-

- Incomplete System Construction: The management system construction at Company H was inconsistent. Some departments used advanced specialized systems, while others still relied on Excel spreadsheets for management. This inconsistency created numerous data silos and departmental barriers, affecting overall operational efficiency.

These management issues led to the following severe consequences:

-

- Data Silos: Core departments like business, risk control, and finance could not work cohesively. For example, the business department used proprietary trading systems, the finance department used SAP, while the risk control department primarily relied on Excel spreadsheets. This created significant barriers to data sharing and synchronization, impacting the accuracy and timeliness of overall decision-making.

-

- Low Work Efficiency: Due to system inconsistencies, front-line data needed to be manually transmitted to risk control and finance departments. According to statistics, risk control and finance staff spent an average of 4-5 hours daily organizing and verifying business data, leading to inefficiency and a high likelihood of errors.

-

- Data Quality Issues: Manual transmission and duplicate input resulted in a 15% error rate in data and compromised timeliness. For instance, inconsistencies between business data, financial data, and risk data frequently occurred, affecting the accuracy of financial accounting and risk assessment.

-

- Lagging Risk Management: Inaccurate and delayed data led to the risk control department’s inability to monitor and assess risks in a timely manner. During the 2018 “black swan” event, the company only fully grasped the situation 48 hours after the loss occurred, missing the optimal risk control window.

-

- Inadequate Decision Support: The management team struggled to obtain timely, accurate, and comprehensive business data. An internal survey revealed that senior executives needed an average of 3-5 working days to receive a comprehensive business report, severely impacting the timeliness and accuracy of decisions.

Facing these challenges, Company H resolutely decided to implement digital transformation. After a thorough evaluation, they chose the Fusion system as their solution, achieving a “trinity” management of business, finance, and risk control.

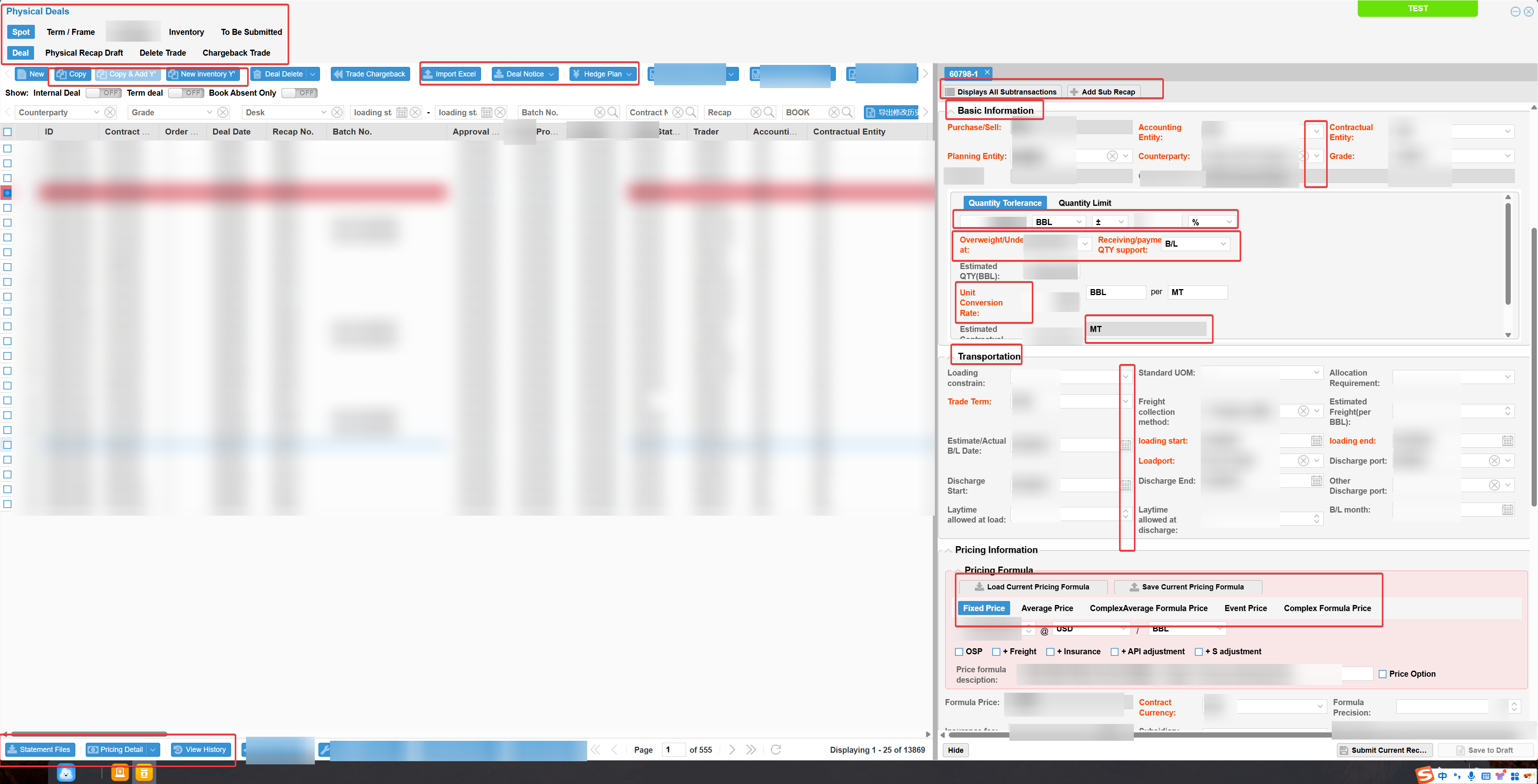

The Fusion system is a comprehensive business lifecycle management platform tailored for the trade and financial industries. Its functionality surpasses traditional CTRM (Commodity Trading Risk Management) and ETRM (Energy Trading Risk Management) systems. Fusion integrates bulk trade business process execution management, financial derivatives hedging trading management, risk control management, and hedge accounting management, thereby achieving unified management of business, finance, and risk control, and thoroughly solving issues of multiple systems, data sources, and inconsistent processes.

After implementing the Fusion system, Company H achieved significant results:

-

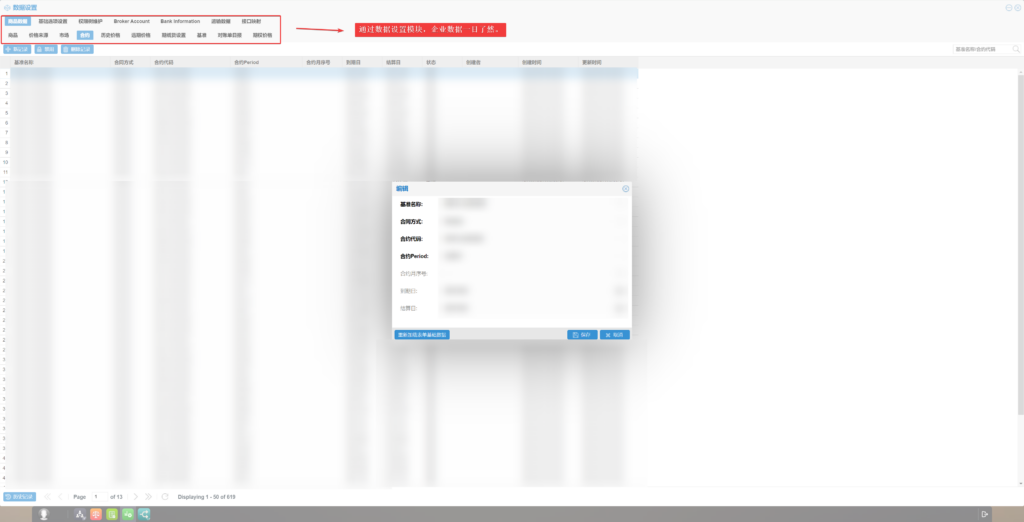

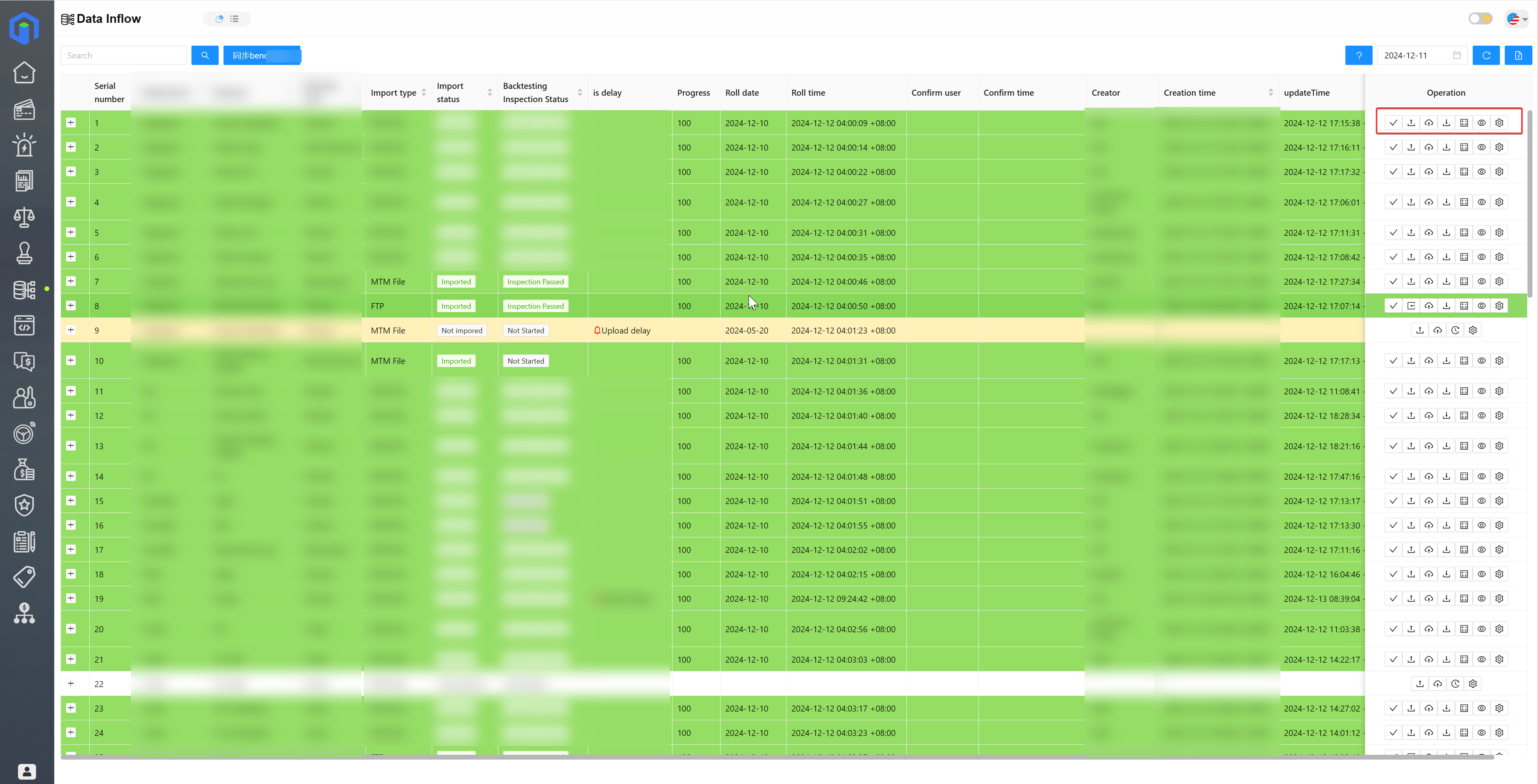

- Data Integration

The Fusion system successfully integrated data previously scattered across various systems, manual spreadsheets, and exchanges through advanced API integration technology. The system also supports manual uploads of personalized business data and stores all data in a standardized format. Additionally, Fusion provides automated data validation features, such as automatic comparison of exchange transaction information, greatly enhancing data accuracy and timeliness.

Specific Results:

-

- Data processing time reduced from 4-5 hours per day to less than 1 hour, with efficiency improved by over 75%.

-

- Data error rate decreased from 15% to less than 1%, significantly improving data quality.

-

- Achieved comprehensive traceability and integrated management of data across business, risk control, and finance.

-

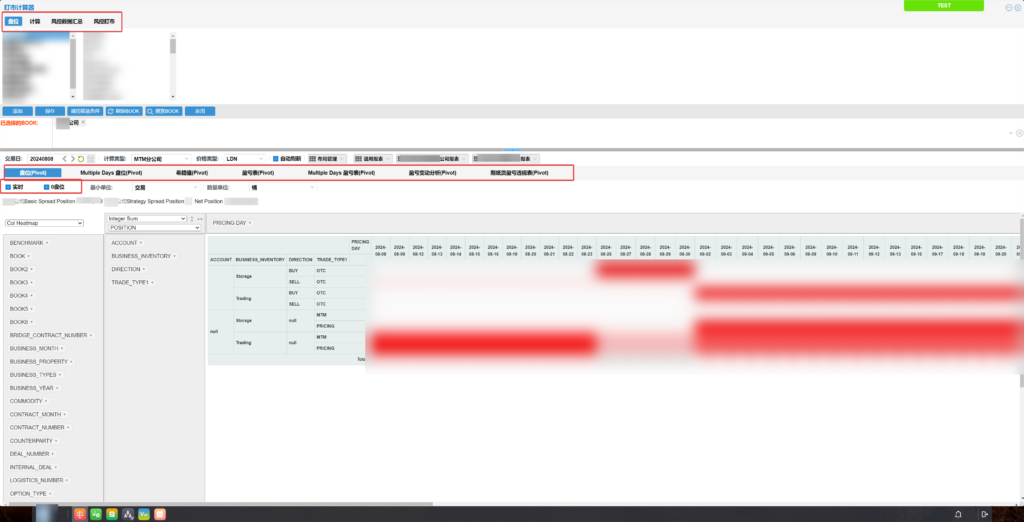

- Trade Monitoring

The Fusion system enabled real-time monitoring of traders, including trading limit monitoring at various levels. The system clearly defines legal trading and position ranges, and triggers risk alerts immediately if limits are exceeded, helping Company H effectively avoid trading risks.

Implementation Results:

-

- Incidence of illegal and limit-exceeding trades decreased by 98%.

-

- Average monthly potential losses avoided were approximately $5 million.

-

- Risk Management

The Fusion system excelled in managing market and credit risks.

Market Risk:

-

- Supports complex floating pricing formulas and real-time mark-to-market profit and loss calculations.

-

- Real-time calculation of integrated exposure and one-stop monitoring of overall corporate profit and loss.

-

- Provides advanced risk management tools such as VAR analysis and stress testing.

Credit Risk:

-

- Market risk exposure visibility improved from T+1 to real-time.

-

- Occurrence rate of credit risk events reduced by 85%.

-

- Successfully averted a potential $150 million risk event in 2019.

Implementation Results:

-

- Market risk exposure visibility improved from T+1 to real-time.

-

- Occurrence rate of credit risk events reduced by 85%.

-

- Successfully averted a potential $150 million risk event in 2019.

-

- Financial Management and Compliance

The Fusion system performed exceptionally in hedge accounting management, supporting hedge scheme management, hedging relationship confirmation, and automatic generation of hedge effectiveness assessment reports. The system also automatically generates hedge vouchers and integrates with the financial system, greatly improving financial accounting efficiency.

Implementation Results:

-

- Hedge accounting processing time reduced by 70%, from an average of 6 hours per day to less than 2 hours.

-

- Financial accounting efficiency improved by 50%, and audit preparation time shortened by 60%.

-

- Data Analysis and Decision Support

The Fusion system provides comprehensive data analysis and reporting functions, including risk control reports, credit reports, inventory reports, and hedge effectiveness assessment reports. These functions facilitate data analysis and process optimization for various departments, and provide timely and accurate decision support for management.

Implementation Results:

-

- Time for management to obtain comprehensive business reports reduced from 3-5 working days to real-time.

-

- Decision response speed increased by 200%, providing critical support for Company H to seize opportunities and achieve counter-cyclical growth during the oil price plunge in 2020.

-

- Collaboration

Through the data integration of the Fusion system, departments achieved efficient collaboration. Back-office staff in finance and risk control can directly access business raw data within the system, while the business department can timely understand risk control and financial data, achieving seamless information flow.

Implementation Results:

-

- Cross-departmental communication time reduced by 80%.

-

- Cross-departmental decision-making time shortened from 7-10 working days to 1-2 working days.

-

- Employee satisfaction increased by 35%, and collaboration efficiency significantly improved.

James Smith, Chief Information Officer (CIO) of Company H, stated, “The implementation of the Fusion system is a key milestone in our digital transformation journey. It not only solved long-standing management challenges but also injected new momentum into our business development. Over the past two years, our operational efficiency has improved by 50%, and our risk management capability has significantly enhanced, translating directly into tangible revenue growth.”

Future Outlook

With the successful implementation of the Fusion system, Company H has outlined a more ambitious digital strategy. The company plans to invest $500 million in the next three years for further technological upgrades, including the application of artificial intelligence and blockchain technology. Company H aims to become the industry leader in digitalization and operational efficiency by 2025.

The developer of the Fusion system, YHWL, also stated that it will continue to enhance system functionality, with plans to launch an AI-based predictive analysis module by the end of 2023, further improving the system’s decision support capabilities.

Conclusion

Company H’s successful transformation through the Fusion system sets a benchmark for the entire energy trading industry. In the digital age, trading companies must embrace advanced technologies and integrate business, finance, and risk control to remain competitive in the intense market. The Fusion system not only resolved Company H’s specific issues but also laid a solid foundation for the company’s future growth and industry-leading position. For any energy trading enterprise looking to maintain competitiveness in the wave of digitalization, Fusion is undoubtedly a solution worth serious consideration.

4 Responses

If you are going for best contents like myself, just pay a quick visit this web page all the time because it provides quality contents, thanks

ok,thanks

Very good article. I certainly love this site. Stick with it!

Thank you.