In the field of bulk energy trade, especially in cross-border transactions of oil and natural gas, maritime shipping has maintained its dominant position due to its high carrying capacity and low cost.

Enterprises of different sizes demonstrate various approaches in managing maritime logistics. A few ultra-large energy companies build their own fleets. They have strong control but incur high costs. Meanwhile, small and medium-sized companies often rely on third-party logistics. Their shipping capacity is limited and their management is simpler.

The leasing maritime model combines the advantages of having an owned fleet and completely relying on third parties. It avoids the drawbacks of both. There is no need to bear high maintenance costs or complex management. It is not constrained by shipping capacity. Thus, it has become the preferred choice for most large and medium-sized energy traders.

Therefore, the leasing maritime model is more representative in enterprise maritime logistics management. This article mainly discusses the leasing maritime logistics management model.

To deeply analyze the challenges and solutions of the leasing maritime model, we select H Company as a representative case. H Company is a large international oil trader with global business and huge annual trade volume. Its leasing maritime logistics and transportation management are both complex and large-scale. In response to these challenges, H Company introduced Fusion. Their goal was to optimize transportation scheduling through digital means, reduce demurrage costs, and improve logistics execution efficiency.

By exploring H Company’s core challenges and Fusion’s optimization solutions and results, we can gain a comprehensive understanding of the pain points and strategies in leasing maritime logistics management. This provides valuable insights for other enterprises using this model.

1. H Company’s Maritime Logistics Management Challenges

Due to the long trade chain, extended transportation cycles, and complex market environment, H Company faces many challenges in maritime logistics management. These challenges mainly fall into the following three aspects:

A.Complex Logistics Scheduling and Risks of Delayed Transportation Execution

Maritime logistics involves many stages, including sales contracts, vessel scheduling, chartering audits, voyage tracking, and coordination at loading/unloading ports. A mistake in any stage may lead to execution delays and affect the overall trade plan. Specifically:

- The matching between logistics elements is unclear. It is difficult to accurately match the status of sales, inventory, and goods in transit. This results in confusion between vessels and cargo. It also affects vessel scheduling and execution, increasing the risk of demurrage fees.

- Port congestion and improper vessel scheduling can cause transportation delays. This pushes up demurrage fees and transportation costs. It may even affect contract performance and profits.

- Deviations in contract execution can trigger disputes. Transportation delays or execution errors may lead to contractual disputes and bring credit risks.

B.Unsynchronized Logistics Information Affecting Trade Execution and Risk Control Management

Maritime logistics covers transportation planning, execution coordination, and settlement. Poor information flow may delay trade execution and affect transaction decisions and risk control:

- Changes in transactions do not trigger timely logistics adjustments. After a contract is modified, if logistics information is not updated simultaneously, it causes a disconnect in transportation, hindering contract fulfillment and decision-making.

- Delays in logistics data impact trade and risk control. If logistics status is not synchronized in real time with trade execution and risk management departments, it becomes difficult to control execution progress. It also interferes with mark-to-market calculations and hedging strategies, thereby increasing market risk.

C.Difficulty in Controlling Logistics Costs, and Limitations in Settlement and Funds Management

Maritime logistics costs are affected by fluctuations in the freight market. They involve complex calculations such as demurrage fees and miscellaneous charges. If logistics and financial data are not integrated, cost control, settlement, and funds management efficiency will be weakened:

- Demurrage fee calculation lacks transparency. Complex contract terms make cost allocation prone to disputes, thereby increasing extra costs.

- Freight calculation is complicated. Issues like floating pricing, multi-party cost allocation, and unclear responsibility reduce settlement efficiency and affect cost control.

- Lack of synchronization between logistics and financial data delays the settlement of freight and demurrage fees. This disrupts business execution and financial planning. It may increase financing costs and reduce fund efficiency.

These challenges result in H Company facing low efficiency, high costs, and significant risks in maritime logistics management. They directly affect profitability. Therefore, H Company decided to optimize its information system and process management. They customized maritime logistics functions within the Fusion (ETRM system). This allowed for precise logistics management and integrated management of transactions, logistics, risk control, and finance. The goal was to reduce costs, improve efficiency, and optimize profit margins.

2. Key Features of Fusion for Maritime Logistics Management

Fusion is a comprehensive CTRM/ETRM management system that integrates business, risk control, and finance. It is specifically designed for energy trading enterprises and offers an integrated solution covering trade management, market risk management, and financial and funds management. In the area of leasing maritime logistics transportation management, Fusion helps H Company achieve optimized logistics scheduling, reduced costs, controlled risks, and improved decision-making through four core modules: logistics consolidation, vessel charter management, transportation execution, and data management.

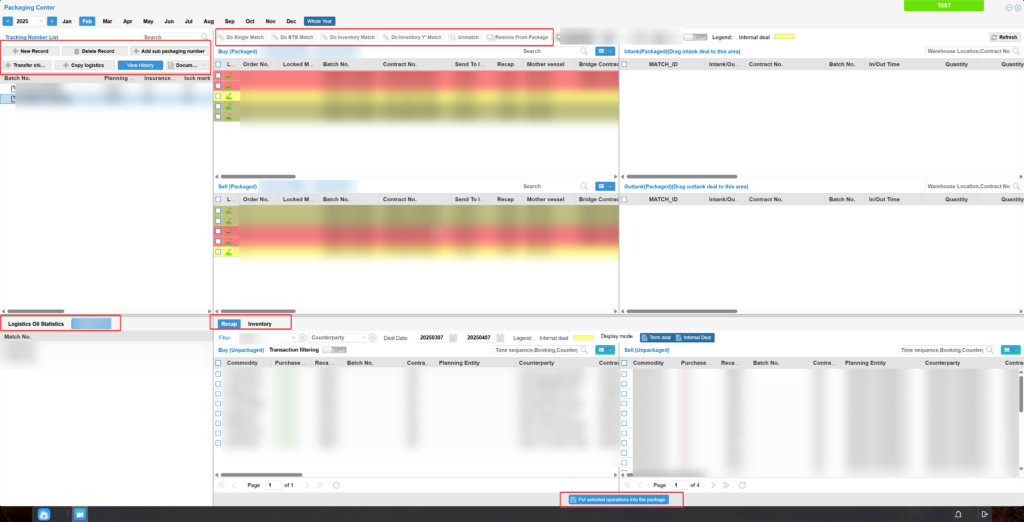

A.Logistics Consolidation Function: Enhancing the Matching Efficiency Between Trade and Logistics

Fusion’s logistics consolidation function supports intelligent matching of trade and inventory contracts. It enables flexible configuration of logistics orders.

- Matching Methods: It supports sales matching, inventory matching, and unilateral matching (for goods in transit that are not yet matched).

- Sub-logistics Consolidation: It allows the addition of sub-logistics for combined management with the main logistics. This optimizes vessel chartering arrangements and freight settlement.

Core Value: This function improves logistics matching efficiency, reduces delays due to complex contract associations, and enhances the precision of transportation planning.

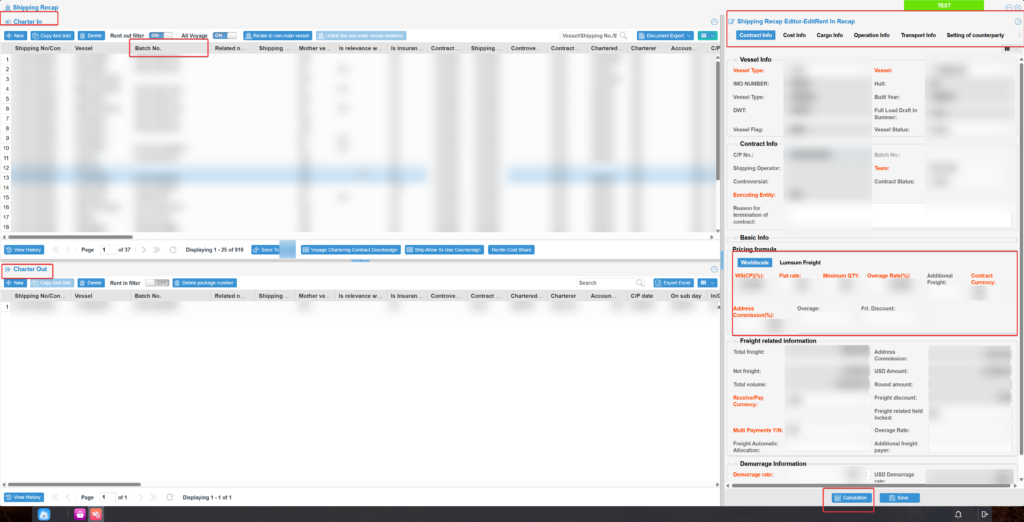

B.Vessel Charter Management Function: Optimizing Contract Management for Voyage Charter and Time Charter

Fusion provides a comprehensive vessel charter management function. It covers both voyage charter and time charter contract and operation management.

- Voyage Charter Management: It supports contract chartering, cost management, cargo scheduling, operation records, and payments, ensuring precise matching between vessels and cargo.

- Time Charter Management: It optimizes time charter contracts and voyage information, improves vessel utilization, and strengthens cost and risk control in chartering.

Core Value: This function helps H Company optimize vessel resource allocation, reduce chartering risks, and improve transportation efficiency.

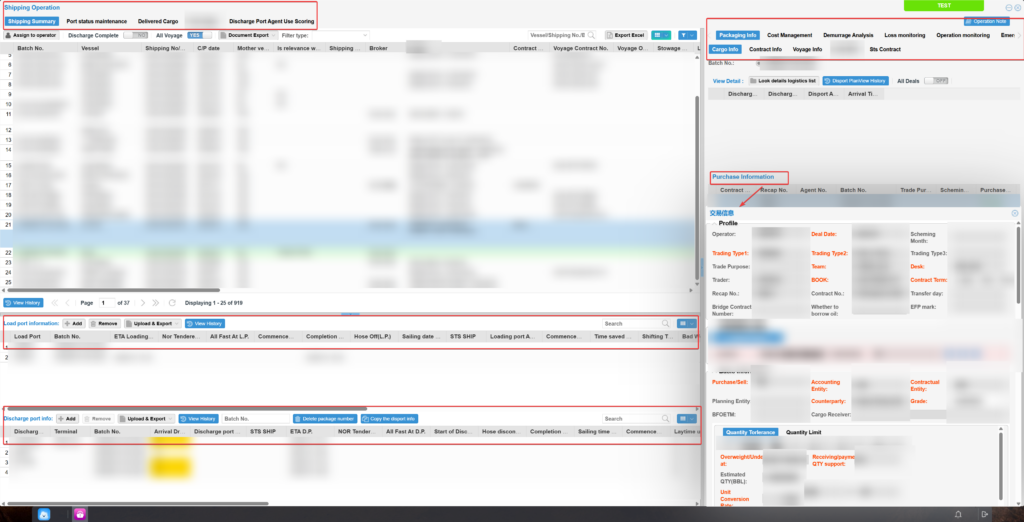

C.Transportation Execution Function: End-to-End Management to Reduce Transportation Costs and Risks

The transportation execution function covers the entire process from vessel scheduling to transportation monitoring. It manages logistics information, cost management, demurrage analysis, fuel consumption and operation monitoring, emergency response to accidents, transportation disputes, and loading/unloading port information. It ensures full control over transportation progress, cost, and quality.

- Dynamic Monitoring of Loading/Unloading Ports: It allows timely monitoring of port operation progress and key dates, reducing the risk of vessel delays.

- Cost and Demurrage Analysis: It automatically calculates transportation costs and provides demurrage fee analysis to optimize cost management.

- Accident Emergency and Transportation Dispute Management: It supports recording of accidents and dispute resolution, thereby improving contract performance.

- Unloading Agent Rating: It evaluates the quality of unloading execution through ratings, providing data support for subsequent optimization.

Core Value: This function reduces logistics risk through full-process monitoring, optimizes transportation costs, and improves operational efficiency.

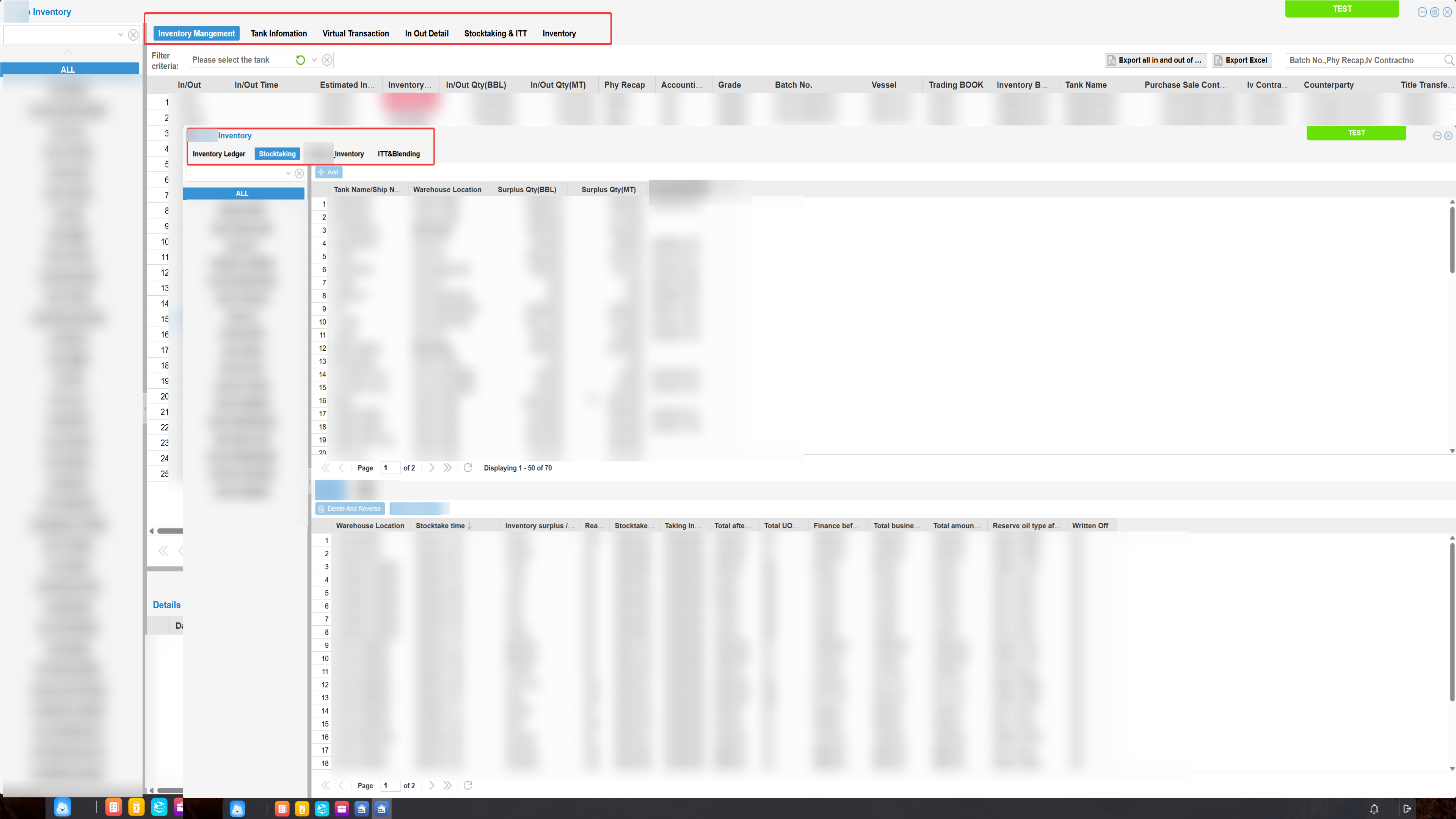

D.Master Data Management and System Integration: Enhancing Data Accuracy and Decision Quality

Fusion supports unified management of core logistics data and achieves seamless integration with external logistics systems.

- Master Data Management: It centrally manages basic logistics data such as vessels, ports, and shipowners. This reduces duplicate entries and improves data accuracy.

- Integration with AIS Systems: It obtains real-time vessel dynamics to optimize transportation scheduling and improve the transparency of logistics execution.

Core Value: By integrating data, this function enhances decision quality and enables efficient collaboration among logistics, trade, and finance.

Through the coordinated operation of these four modules, Fusion provides H Company with a systematic management approach to precisely control the entire maritime logistics process. The following section will analyze in detail how these functions address H Company’s core challenges in logistics scheduling, information synchronization, and cost control, thereby improving contract fulfillment, reducing costs, and enhancing market competitiveness.

3. Fusion Maritime Logistics Management Solution: Precisely Addressing H Company’s Core Challenges

A. Precise Logistics Scheduling and Efficient Transportation Execution

a.Clear Matching, Optimized Vessel Schedules – Solving Logistics Matching and Vessel Scheduling Issues

Logistics Consolidation Function Integrates Matching Relationships

To resolve logistics matching problems, the system uses a logistics consolidation function. It cleverly integrates sales matching, inventory matching, and the status of goods in transit (unilateral matching). This forms a clear flow of goods and ensures precise matching among trade contracts, inventory contracts, and logistics.

Vessel Trading Module Supports Unified Management

The Fusion vessel trading module supports binding logistics orders. This helps match vessels and cargo. Information on vessels, cargo, and charter contracts is displayed clearly. It achieves unified management of trade, inventory, and logistics. This greatly improves the transparency of transportation execution.

Optimizing Plans by Combining Historical and Real-Time Data

Fusion supports the use of logistics consolidation and vessel charter management modules while integrating historical execution data and AIS information to optimize transportation plans. The system provides key data such as ETA, speed, voyage length, and historical routes. These assist transportation personnel in planning transport times reasonably and optimizing vessel schedules. This effectively reduces logistics delays caused by planning errors.

These functions not only reduce vessel delay and demurrage fee costs but also improve vessel charter utilization and optimize logistics cost control. They provide important guarantees for stable contract fulfillment and reduced credit risk.

b.Real-Time Monitoring, Selecting Optimal Agents – Tackling Port Congestion and Vessel Scheduling Challenges

Real-Time Vessel Operation Monitoring

To address the issues of port congestion and improper vessel scheduling, the system, via the transportation execution module, uses vessel fuel consumption and operation monitoring combined with integrated AIS data. This achieves real-time vessel monitoring, allowing the logistics team to keep track of vessel dynamics at all times. It also records detailed loading/unloading port information, such as arrival time, berthing time, and progress of loading/unloading operations, thus enhancing information transparency.

Selecting Efficient Port Agents

Additionally, the system supports a port vessel agent rating function to select efficient agents and improve port operation efficiency.

With these functions working together, the logistics team can respond quickly to changes, precisely schedule vessels, effectively reduce the risk of port congestion, and lower demurrage fees and transportation costs.

c.Comprehensive Recording and Rapid Response – Resolving Risks of Contract Execution Disputes

Comprehensive Recording of Key Data

The system records key data throughout the process of vessel chartering, transportation, loading/unloading, and vessel schedule adjustments. This creates a complete log to ensure that operations can be verified.

Transportation Dispute Management Function

The transportation execution module’s dispute management function records in detail the time nodes, responsible parties, and reasons for disputes. It supports quick problem identification and solution development.

This approach not only reduces the occurrence of contract execution deviations and disputes at the source but also accelerates dispute resolution after they occur. It clearly assigns responsibility and effectively reduces manual coordination costs. Ultimately, Fusion helps enterprises significantly lower legal litigation and credit risk.

B. Synchronization of Logistics Information and Business Collaboration Management

a.Data Linkage, Synchronized Updates – Solving the Problem of Delayed Logistics Information Updates

To address the issue of logistics information not being updated in a timely manner, Fusion uses a data linkage mechanism. This mechanism ensures that changes in trade contracts promptly trigger adjustments in logistics plans.

For example, when the content of a trade order is modified, the cargo information in the transportation execution module is updated synchronously. This ensures that trade execution, transportation plans, and contract fulfillment remain consistent, reducing the risk of disconnects.

This improves the flexibility and responsiveness of the trade process and ensures the smooth execution of the overall trade plan.

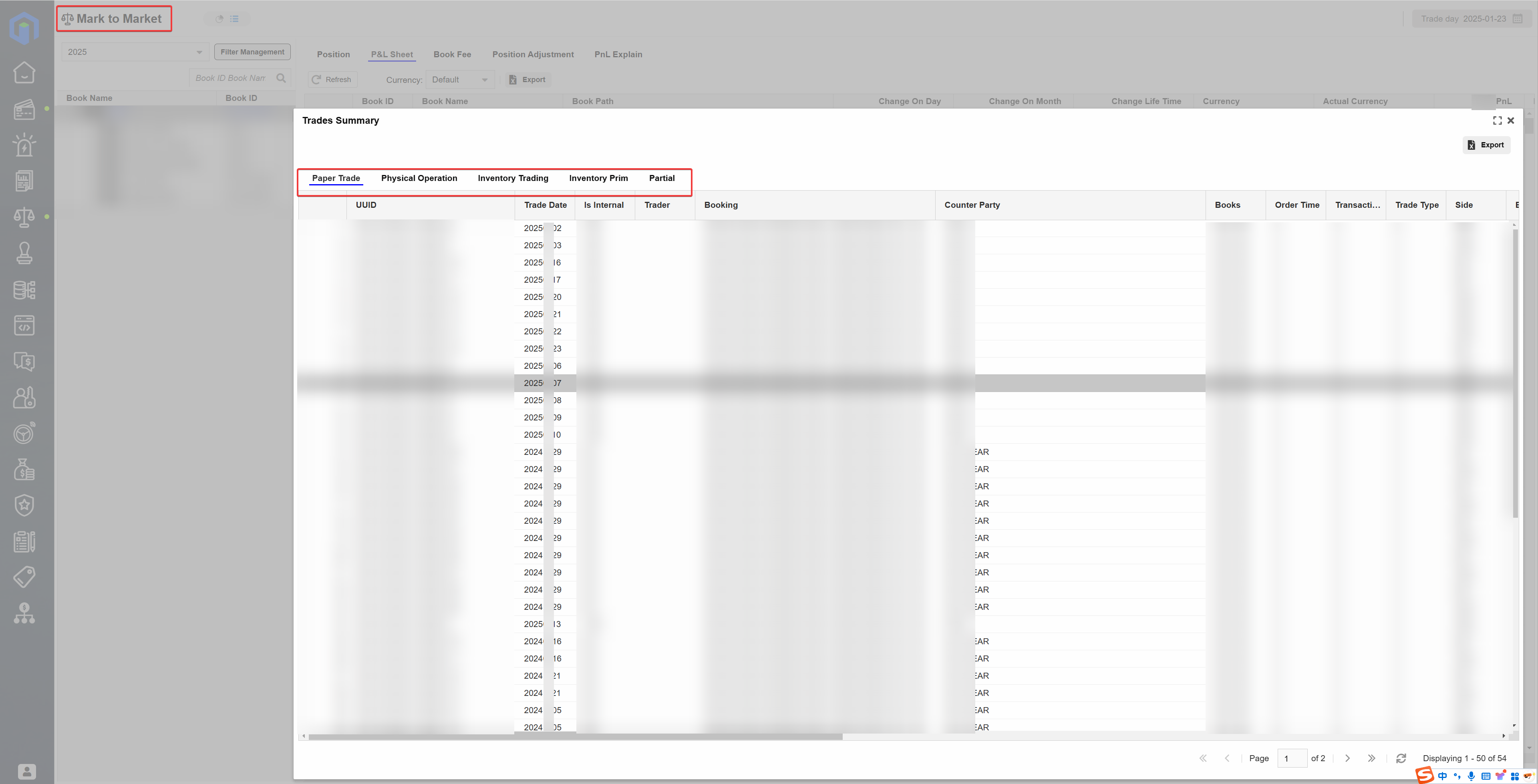

b.Real-Time Synchronization, Precise Risk Control – Tackling Logistics Data Lags

Synchronizing Logistics Data with Trade Execution

When logistics data lags and impacts trade execution, the system’s automatic synchronization mechanism ensures that logistics information is reflected in the trade execution module in real time. This allows trade execution personnel to monitor transportation progress and adjust plans promptly, reducing operational risks.

Linking Logistics Data with Risk Control Management

At the same time, Fusion tightly integrates logistics data with risk control management. This integration provides accurate market risk judgment for risk control. For example, through dynamic port monitoring, key time nodes such as arrival, departure, berthing, and loading/unloading are strictly managed. Risk control can optimize hedging plans accordingly.

Through real-time mark-to-market calculations, logistics data is combined with risk control models. This ensures that the mark-to-market calculation reflects the latest transportation status and that market risk exposure is accurate.

Thus, the linkage between logistics data and risk control management reduces mark-to-market errors caused by data lags. It improves the accuracy of hedging strategies and reduces market risk.

In summary, synchronizing logistics data not only enhances business collaboration efficiency but also effectively avoids unnecessary losses caused by data delays. This strengthens the enterprise’s market competitiveness.

C. Logistics Cost Control and Financial Funds Management

a.Automatic Calculation, Transparent Allocation – Solving the Problem of Demurrage Fee Calculation

Automatic Calculation of Demurrage Fees

Facing the difficulty of calculating demurrage fees, the system uses an automated calculation mechanism to accurately compute these fees. It also supports a visualized calculation process, ensuring that the fees are transparent and clear, effectively reducing contract disputes.

Analysis of Demurrage Causes

The transportation execution module includes a function to analyze the causes of demurrage. It helps identify the main sources of demurrage costs (such as port loading/unloading delays, weather impacts, vessel schedule adjustments, etc.). Using an intelligent allocation mechanism (supporting both automatic and manual allocation), it fairly divides fee responsibilities and optimizes cost management.

This improves the accuracy and compliance of demurrage fee calculation, reduces additional demurrage fee expenses, and enhances H Company’s financial management flexibility and transportation execution efficiency.

b.Flexible Calculation, Clear Allocation – Addressing the Complexity of Freight Calculation

Supporting Two Freight Calculation Models

Regarding freight calculation, the system supports both floating freight rates and lump-sum rates. It flexibly adapts to different contract terms, ensuring that fee calculations are accurate.

Automated Freight Accounting and Allocation

Fusion supports automated freight accounting. Based on the transportation plan and freight data, it quickly calculates various fees. This greatly reduces manual calculation errors and disputes.

For freight allocation, the system offers both automatic and manual allocation functions. This ensures that fee attribution is clear and prevents settlement disputes.

This not only improves the accuracy of freight accounting and financial processing efficiency but also strengthens H Company’s cost control capabilities. It provides strong support for maintaining competitiveness in the global maritime market.

c.Automatic Synchronization, Optimized Funds – Solving the Problem of Logistics and Finance Not Being Synchronized

Synchronization of Logistics and Financial Data

To address the issue of unsynchronized logistics and financial data at H Company, Fusion provides an efficient solution.

In addition to supporting the automatic calculation and allocation of logistics costs such as freight and demurrage fees, it also supports the automatic synchronization of logistics cost data to the settlement module. It automatically generates financial vouchers, speeds up the settlement process, and greatly reduces settlement errors and delays.

Precise Logistics Costing, Optimized Fund Allocation

The precise logistics cost calculation and real-time data synchronization provide the financial team with accurate cost data. This allows them to plan cash flows in advance, optimize fund allocation, and reduce short-term working capital risk.

This solution not only improves the accuracy and efficiency of financial settlements but also enhances the enterprise’s funds management capability. It reduces financing costs and plays an important role in H Company’s operations and development.

Through the implementation of Fusion’s specialized logistics functions—such as consolidation, vessel chartering, and transportation execution—H Company’s maritime logistics management level has been significantly improved. The overall implementation results are as follows:

- Cost Reduction: Vessel delays reduced by approximately 30%, extra demurrage fee expenditure lowered by 25%, and freight calculation errors decreased by 40%. This effectively reduces logistics costs.

- Efficiency Improvement: Transportation execution transparency is increased, vessel charter utilization improves by 20%, trade process response speed increases by 35%, logistics information synchronization rate reaches 95%, and overall business collaboration efficiency is greatly enhanced.

- Risk Reduction: The incidence of contract execution disputes drops by 50%, legal litigation and credit risk are reduced by 40%, and market risk exposure errors decrease by 30%, enhancing the stability of enterprise operations.

- Funds Optimization: Financial settlement efficiency improves by 45%, short-term working capital risk is reduced by 25%, and funds management capability is significantly enhanced.

4. Conclusion: Technology Empowerment and Industry Insights

H Company’s practice has validated the core value of Fusion in maritime logistics management. Through four key functions—logistics consolidation, vessel charter management, transportation execution, and data collaboration—the enterprise not only solved issues like scheduling delays, information silos, and uncontrolled costs, but also achieved integrated collaboration among trade, risk control, and finance. This case offers important lessons for the bulk energy trade industry:

- Technology Drives Efficiency: Digital tools (such as ETRM systems) can significantly enhance logistics transparency and response speed while reducing human error.

- The Necessity of Holistic Collaboration: Real-time integration of logistics, trade, risk control, and financial data is the foundation for optimizing decisions and reducing costs.

- Continuous Iteration to Meet Challenges: In the face of shipping market fluctuations and supply chain uncertainties, enterprises must continuously optimize their technology and management strategies.

Future Outlook,The industry may further explore the application of technologies such as artificial intelligence and blockchain in maritime logistics to build a more resilient global energy trade network.