Product Story

X-Ray: Innovating Data Governance in Digital Transformation

This article explores how X-Ray drives data governance and helps businesses achieve smarter decision-making and efficient operations in digital transformation.

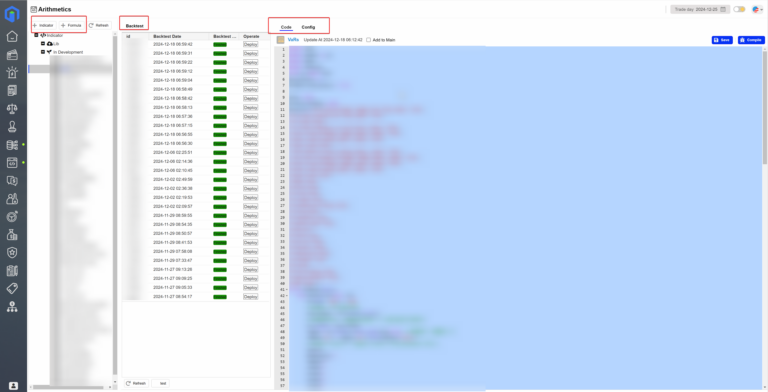

X-BT: The Smart Platform for Complex Data, for All Users

The X-BT platform offers tailored tools for users to efficiently process data, optimize decisions, and improve business efficiency.

Unlocking Data Potential: How X-Ray Boosts Decision-Making

X-Ray is an intelligent tool that streamlines data governance, analysis, and decision-making for faster, more accurate business decisions.

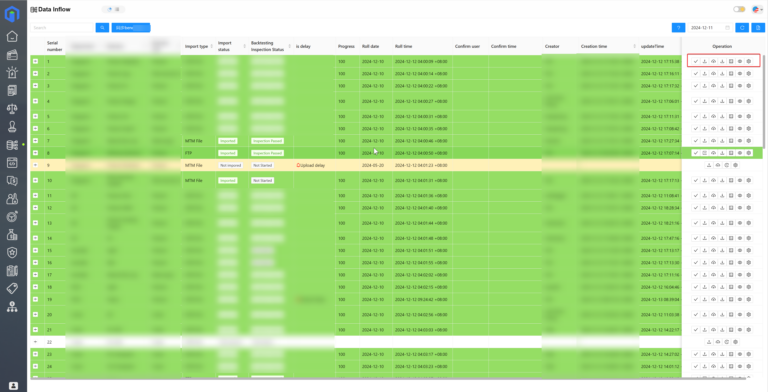

X-Ray XDK: A Tool for Multi-source Data Integration

The X-Ray XDK Data Collection Toolkit focuses on integrating and processing internal and external enterprise data, helping businesses break down “data silos.”

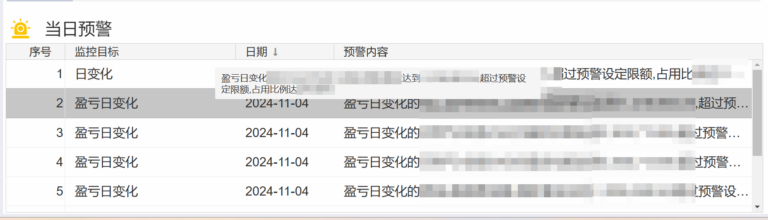

Real-Time Monitoring & Alerts: X-Ray’s X-Eagle in Action

X-Ray’s X-Eagle focuses on real-time monitoring and alerts. This article highlights its core features and value in the commodities trade industry.

Visualizing Data: X-Ray’s Feynman Language and X-Insight

This article explores how X-Ray’s Feynman Language and X-Insight dashboard offer a more efficient solution to traditional data visualization limitations.

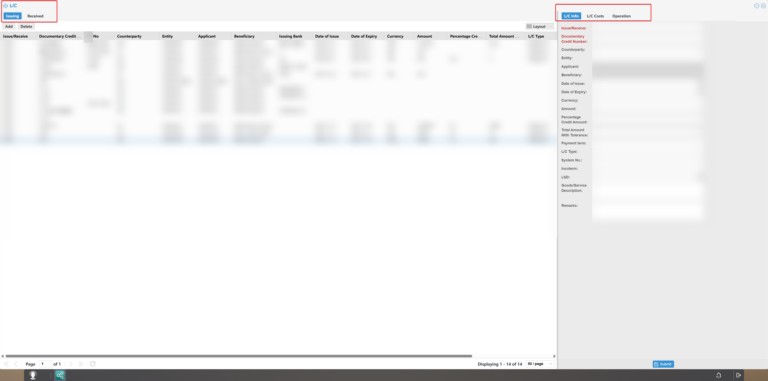

Fusion Applied: Credit Risk Management for Commodity Trading

Fusion CTRM combines standardization and customization to deliver efficient credit management, as shown in practical case studies.

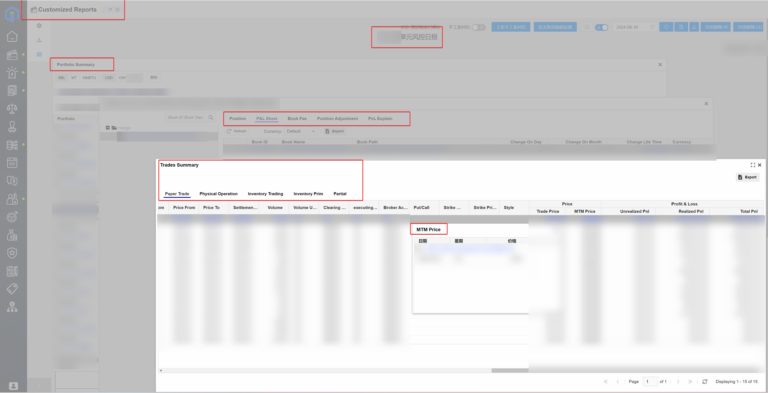

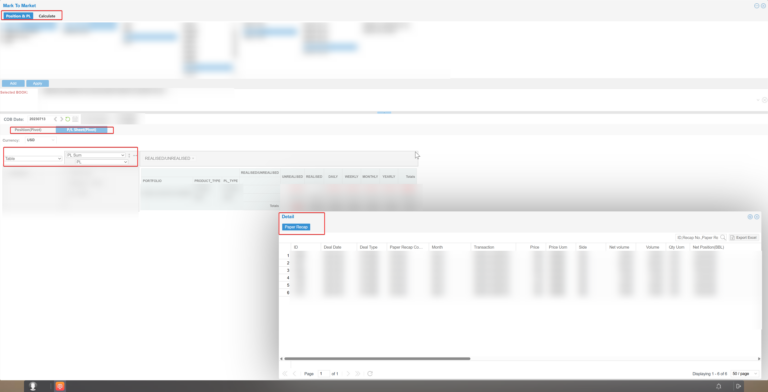

Fusion Solution: Commodity Trading Market Risk Management

Fusion CTRM provides the trading industry with a complete set of market risk management solutions to enhance enterprises’ risk resilience.

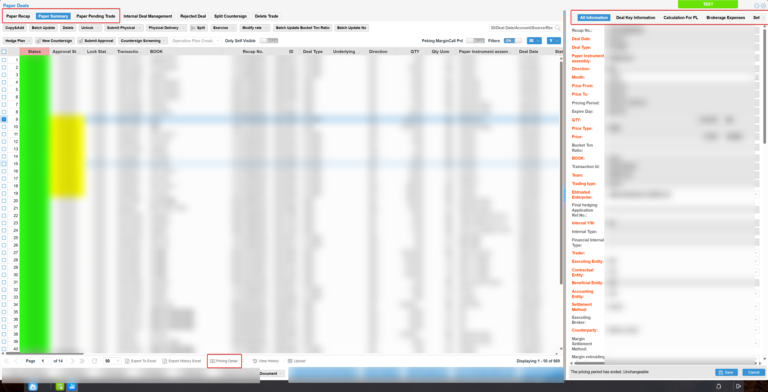

Fusion Derivatives Trading: Systematic & Tailored Practices

This article discusses challenges in derivative hedging management and how Fusion solutions enhance enterprise risk management.

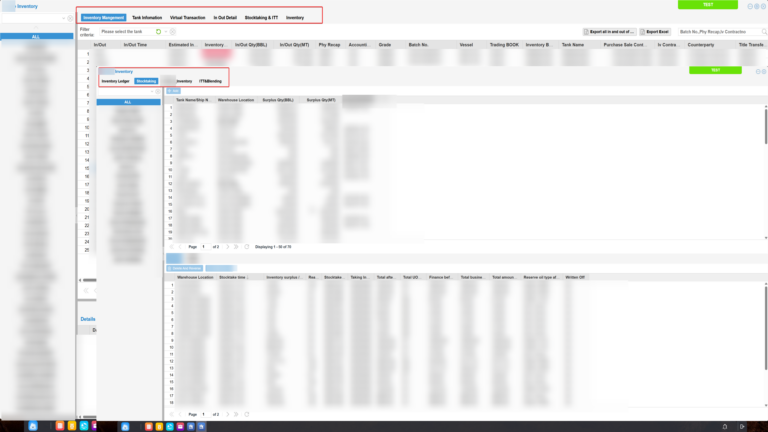

Tackling Energy Inventory Challenges with Fusion

This article explores how Fusion CTRM/ETRM transforms energy inventory management, driving the shift from managing goods to managing assets.

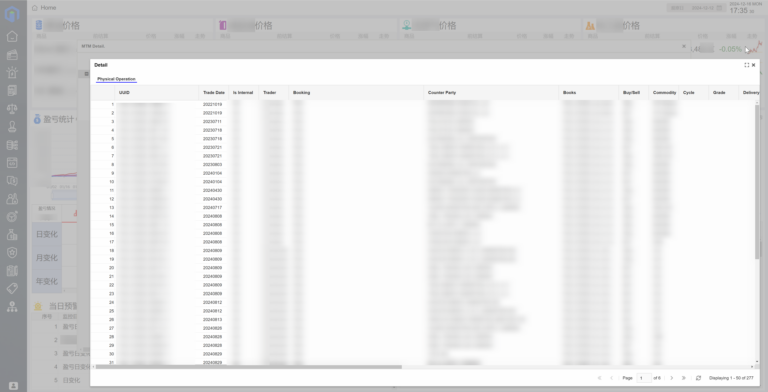

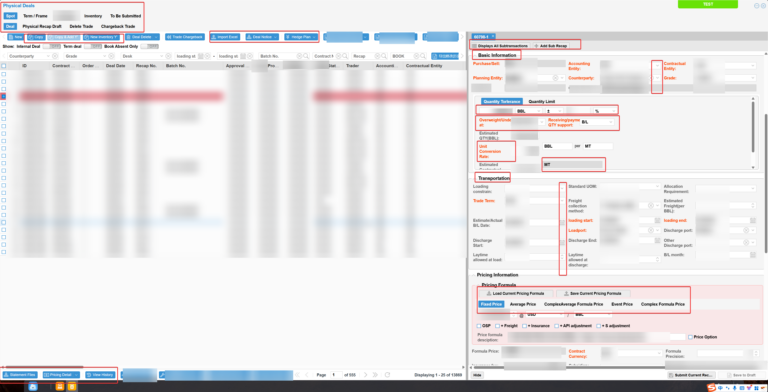

Fusion: Smart Solutions for Physical Commodity Trading

This article will discuss challenges in physical trade management and how Fusion improves efficiency and transparency through automation.

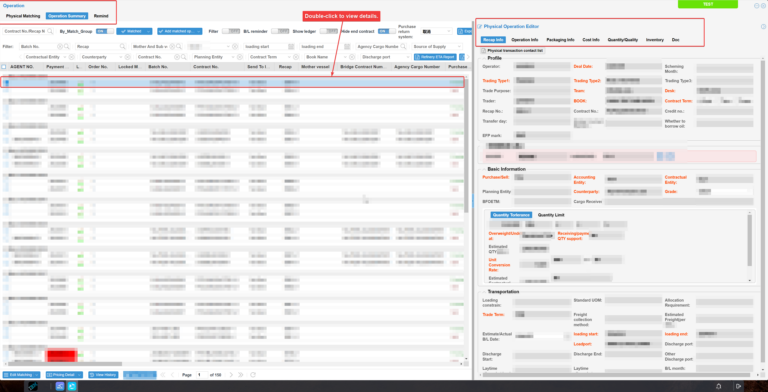

How Fusion Eases Trade Management in Financial Challenges

This article will explore how the Fusion system simplifies trade management, optimizes risk control, and boosts operational efficiency.