The wind of SaaS comes in waves.

Around 2015, considered as the first year of SaaS in China, domestic capital saw the potential of SaaS following the flourishing development of the SaaS market in the United States. Many SaaS companies were established around that time, including the publicly listed company Weimob.

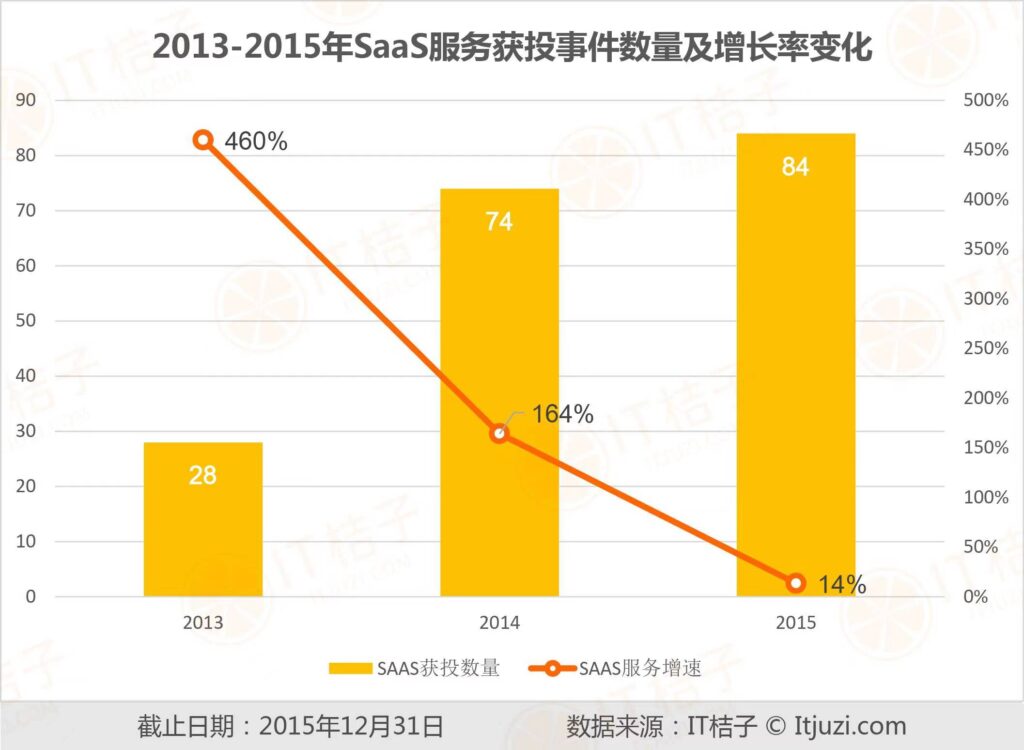

According to data from IT Orange, in 2015, there were 84 investment events in SaaS services, totaling nearly 4 billion RMB. Many companies received funding shortly after their establishment, indicating a positive outlook.

(Image Source: IT Juzi)

However, in the two years following 2016, investment declined. Internet giants faced challenges, financing became difficult, and the competition intensified. SaaS startups experienced a cooling period. From 2019 onwards, with improvements in the investment environment, policy support for cloud adoption from the Ministry of Industry and Information Technology, and increased awareness of SaaS, the development environment for SaaS improved. The impact of the pandemic also boosted the development of SaaS tools for online live streaming, leading to positive sentiments and expectations of a potential boom.

Nevertheless, since 2022, the sentiment around SaaS has turned pessimistic. On Zhihu, a question arose – “Is SaaS really suitable for China?” With over 200 responses, doubts were raised, and terms like “crossing the calamity,” “dead end,” “tragedy of SaaS,” and “winter” were widely used.

In response to these developments, some industry insiders provided their insights:

A: “Previously, it was about financing and storytelling. Now, it’s about self-examination and cash flow.”

A’s perspective reflects the current challenges – financing is harder to secure, and many SaaS companies are operating at a loss.

According to IT Orange data, the investment environment for SaaS is different from previous years. In the first seven months of 2023, only 50 investment and financing events occurred in the SaaS industry, a sharp decline from 153 and 120 events during the same period in 2021 and 2022, respectively.

Half of the SaaS companies listed on the Hong Kong Stock Exchange are in a loss-making state.

In its half-year report released in August, Weimob revealed an operating loss that expanded by 285.2% year-on-year to 631 million RMB, and the adjusted net loss increased by 499.2% year-on-year.

Looking at the overall development of SaaS, being poured cold water is seen as a positive sign. While capital can inflate valuations, SaaS is a long-term business, and relying solely on burning capital for blind growth does not solve the fundamental issues.

1 SaaS is a Long-Term Business

Why is SaaS considered a long-term business?

Because SaaS relies on continuous payments. Originally stemming from Salesforce, the SaaS (Software as a Service) model is designed for user convenience.

It involves leasing software products from the cloud to enterprises and features characteristics like cloud deployment, web delivery, subscription-based pricing, and standardization.

This approach offers advantages such as easy deployment, strong scalability, flexible payment, collaboration facilitation, easy iteration, low cost, quick onboarding, and mobile accessibility.

However, SaaS is on-demand, and if a product fails to continually empower users, they can easily cancel their subscriptions. While a company might convince users to stick with a subpar product for a year, convincing them to renew annually is a different challenge.

Industry insider B puts it this way: “In the first year, SaaS basically satisfies the cost. It’s in the second year that renewal starts to make money.” If a company fails in the first year, there’s no talk of making money; quick fundraising is not that easy.

Therefore, the key is how to provide sustainable services that encourage users to renew.

However, the current pessimistic sentiment around SaaS is due to many products failing to continuously meet user needs.

C: “Large enterprises need customization, and small and medium-sized enterprises lack the money.”

D: “The product’s value is just a bluff; it doesn’t solve real pain points.”

E: “Many standard SaaS solutions can only address half of the customer’s problems; the other half needs customized solutions.”

These responses from industry insiders highlight issues such as the inability to meet customization needs, weak renewal capabilities for small enterprises, and the failure to address users’ real pain points, leading to a lack of willingness to pay.

In fact, the pessimistic sentiment around SaaS goes beyond these issues.

2 Contradictions Between SaaS Standardization and Customization

Through discussions with industry insiders and social media discourse, it’s evident that the term “customization” is frequently mentioned in the context of SaaS standardization:

User 1: “The underlying layer of SaaS is shared with other clients, making some customizations impossible. Even if customization is possible, it may not be deployed in a timely manner, considering the time constraints of other clients.”

User 2: “As business digitization deepens, the demand for customization is increasing. It’s not only about adapting to process scenarios but also about being user-friendly and practical. Many standardized software and SaaS solutions face challenges because frontline users in business refuse to use them, not because bosses and CIOs don’t buy in!”

It can be seen that SaaS faces difficulties in meeting enterprise customization needs, and data supports this point. Research by the Haibie Research Institute on the pain points of users in five major SaaS markets shows that the inability to meet personalized demands is a significant issue. In categories like office communication, data analysis, operational management, and vertical industries, personalized demand pain points are ranked first or second, with these four categories accounting for over 90% of the market share in 2022.

So, why are Chinese enterprises so obsessed with customization?

Many users mentioned the issue of management standards: “For SaaS, the key is whether business standards or corporate governance standards can be unified. If business models or standards vary widely, public SaaS becomes irrelevant. This is a direct reason why many enterprises choose customized development.”

The inability to unify business standards is related to the short duration of industrialization in China, insufficient accumulation of management experience, significant market changes, and the need for flexible adaptation. It’s also related to the underdevelopment of relevant laws and regulations, with relatively simple compliance requirements. Conversely, in countries with longer industrialization periods, mature management experience, and high levels of business standardization, there are standardized business processes in areas such as finance and sales. They also have professional managers using similar management processes. For the sake of compliance complexity, companies there use SaaS to help avoid compliance risks and save costs.

As a result, SaaS development is more mature in foreign countries, especially in the United States, where it holds 65% of the global SaaS market share in 2022.

3 SaaS Data Security Issues

The pessimism surrounding SaaS is closely tied to concerns about data security arising from cloud deployment.

Data from the Haibie Research Institute shows that among the factors considered in procurement, data security is one of the concerns for SaaS software. In the five main SaaS software categories, data security is consistently ranked first among procurement factors. First Voice data also shows that data security accounts for 51.76% of the factors considered in software procurement, ranking first among all factors.

It is evident that when procuring SaaS, enterprise customers are most concerned about the data security capabilities of the service.

Industry insiders also shared some typical cases to highlight the importance of data security:

“I was in communication with a solution provider, and they directly opened up a client system for demonstration…”

“An employee of a certain cloud platform unauthorizedly leaked user registration information stored on the cloud platform to a third-party cooperating company without user consent.”

After reading these cases, it’s clear that if SaaS services cannot protect customer data, it would be advisable not to use them.

4 SaaS Ecosystem Issues

A user on the topic of SaaS ecosystem issues shared, “I once experienced the painful process of choosing SaaS. As the company’s business expanded, we needed an all-in-one platform solution for CRM, ERP, inventory management, logistics, finance, tax reporting, and customer service. However, after investigating and consulting with many SaaS service providers, the result was that none of them had a complete solution with all the required functionalities.”

This response indicates that many users want an integrated solution, but the reality is that SaaS with poor ecosystems struggle to provide such products.

Why is this the case?

Because SaaS companies require collaboration with channel partners and ecosystem partners for infrastructure, technical development tools, platforms, channel solutions, business consulting, system integration, etc. Very few SaaS companies handle all aspects of upstream and downstream business on their own.

Data also shows that nearly 50% of SaaS companies have a median contribution to ARR directly from channel partners, reaching 25%, and in some cases, even 70%. Only 2% of SaaS companies generate revenue entirely on their own.

This suggests that SaaS revenue is influenced by the health of the channel ecosystem, and those relying solely on self-sufficiency are rare.

However, the current SaaS ecosystem is not mature enough. There are no unified industry standards, and a smooth supply chain from upstream to downstream has not been established. Many industry insiders also see this problem, as one person noted, “The weight of SaaS depends on the establishment of standards within the industrial system. Why use Adobe? Why use Autodesk? Why use Office? Is it because the software is well-written? … When your upstream and downstream are all using it, what choices do you have?”

I also agree; only when standards are established within the entire system can the ecosystem use the same products. This is similar to how we all use WeChat today. If you don’t use it, you can’t participate in daily social activities. You must use it, and WeChat has thus formed a massive social circle, supporting many businesses that rely on traffic.

In conclusion, the development issues of SaaS go beyond what has been discussed. Regarding customization issues, there is now a solution like aPass, establishing aPass-enabled enterprises can meet some of the personalized needs of users.

However, in the long run, it still depends on the maturity of management standards. Data security issues and ecosystem issues depend on the soundness of domestic laws and regulations, the cultivation of data security awareness, the development progress of cloud computing technology, the maturity of underlying IT standards, and the completeness of infrastructure. It is a long and arduous journey that requires time to settle.

So, the path of SaaS should be taken calmly and patiently.

References:

- IT Orange Annual Review 15: Observations on SaaS Service Venture Capital, with total funding 10 times that of 2013. IT Orange Public Account, 2016-01-22

- Salute, China’s SaaS in these ten years. Niu Toutiao Public Account, 2023-09-15

- One point. Big Tech Group. China’s SaaS industry awaits the “moment of crossing calamity.” Yidian Caijing Public Account, 2023-10-11

- Market Value List Team. China’s SaaS tragedy: How the gap has been widening step by step. Market Value List Public Account, 2023-06-07

- Chang Le. The situation of domestic SaaS companies is more severe than imagined. ToBeSaaS Public Account, 2023-01-05

- China SaaS Market Research and Selection Evaluation Report 2022. Produced by Haibie Research Institute, 2022-08

- First Voice Research Department. 2022 China High-Growth Enterprise SaaS Industry Research Report. First Voice

- Dai Ke. The situation of domestic SaaS companies, far more severe than imagined. ToBeSaaS Public Account, 2023-11-26

- Thanks to industry insiders and netizens for providing first-hand information.

2 Responses

Aw, this was an extresmely good post. Spending some time and actual efffort to create a really good article…

but wuat can I say… I put things off a whole loot andd

never seem to get nearly anything done. https://Lvivforum.pp.ua/

Thank you for your attention.