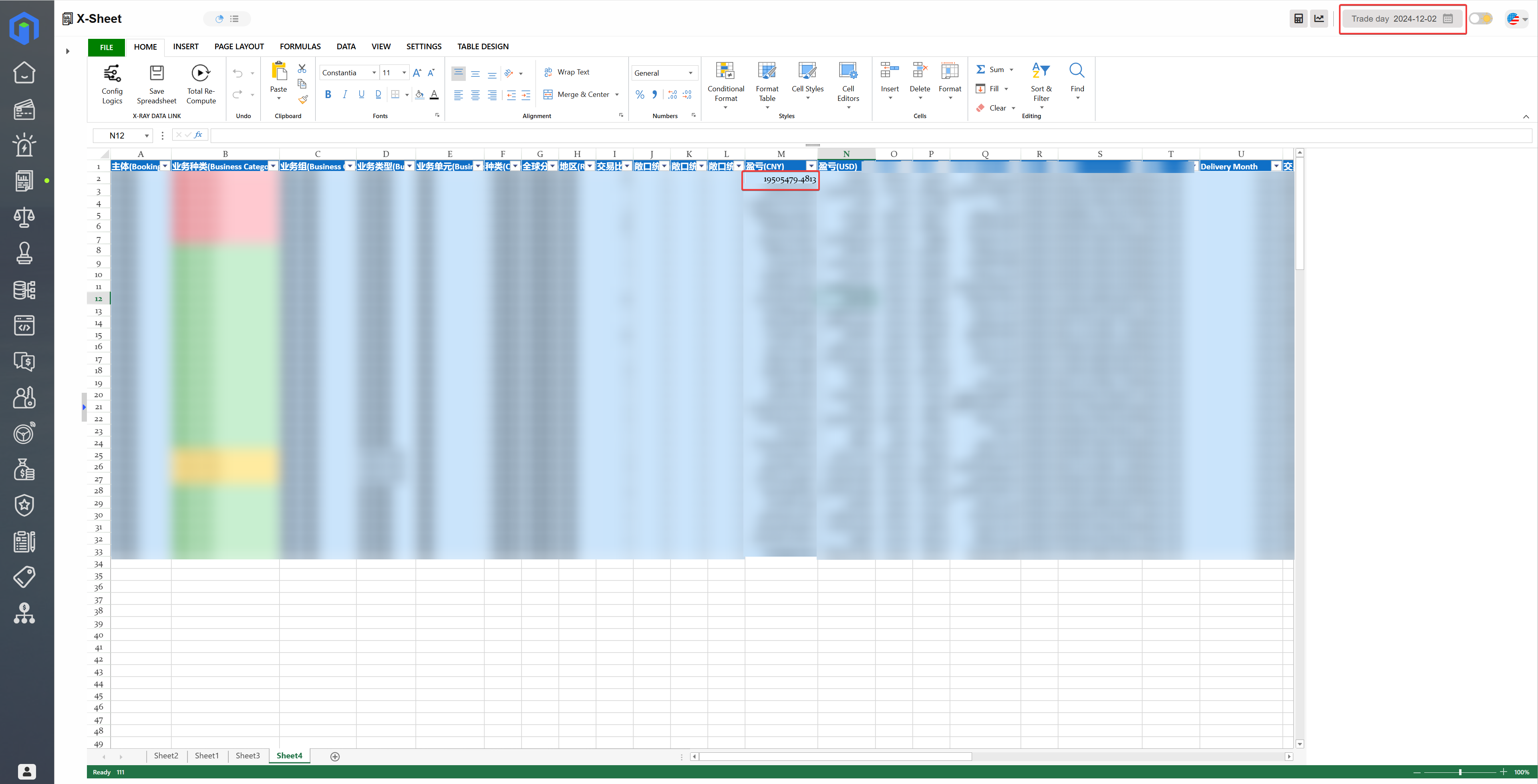

Abstract: This article will showcase the value and advantages of X-Ray in the financial industry through four specific application cases. From stock trading strategies to risk management, compliance supervision, and credit assessment, X-Ray, as a powerful tool for data-driven decision-making, enhances the accuracy and efficiency of decision-making processes in financial institutions. It brings better risk control and compliance management. Let’s unveil the mystery of X-Ray in the financial industry.

Enhancing the Quality and Efficiency of Stock Trading Strategies

Suppose an investment bank wants to develop a stock trading strategy based on market trends and indicators. With X-Ray, the investment bank can optimize the data-driven decision-making process through features such as data collection, model building, and backtesting. X-Ray provides a Data Development Kit (XDK) and a range of analysis tools to help analysts gather market data from various sources and construct optimized trading strategy models. The backtesting framework (X-BT) evaluates the historical performance of strategies, and the real-time monitoring and alert system (X-Eagle) ensures timely adjustments. The application of X-Ray enables the investment bank to identify market trends more accurately, execute trading strategies, and maximize investment returns.

Strengthening Risk Management and Control Capabilities

In the financial industry, risk management is crucial. X-Ray’s data decision-making process offers robust risk management tools to assess and control various risks. Through X-Ray’s data collection and integration features, institutions can access real-time market data, economic indicators, and internal risk data from different sources. X-Ray’s model building and analysis tools assist institutions in risk assessment and stress testing, aiding in the formulation of risk management strategies. The X-Eagle alert system monitors market data and risk indicators in real-time, issuing alerts to prompt institutions to take appropriate risk control measures. Through X-Ray’s application, financial institutions can better identify and manage risks, safeguard assets, and protect customer interests.

Optimizing Compliance Supervision and Reporting Processes

Financial institutions need to comply with strict regulatory requirements, and compliance management often involves extensive data collection, analysis, and reporting. X-Ray provides a comprehensive compliance supervision solution, enhancing efficiency by automating data collection, integration, and analysis to meet regulatory requirements. X-Ray’s Data Development Kit (XDK) and model-building tools allow institutions to automatically collect and organize data required for compliance from various sources. Leveraging the Feynman language and computation library based on X-Ray, institutions can conduct compliance checks and risk assessments, generating reports and documents that comply with regulatory requirements. The application of X-Ray enables institutions to more efficiently meet compliance regulatory requirements, reducing compliance risks, and minimizing human errors and repetitive work.

Improving the Accuracy and Comprehensiveness of Counterparty Credit Assessment

In the financial industry, evaluating counterparty credit is a critical step in the decision-making process. X-Ray provides financial institutions with comprehensive capabilities for counterparty credit assessment through rich data collection tools and model-building tools. By collecting and integrating credit-related data from various sources, such as financial information, transaction records, and credit ratings, institutions can use X-Ray’s analysis tools for counterparty credit assessment and model building. X-Ray’s backtesting framework and real-time monitoring system help institutions track counterparty credit conditions in real-time, issuing alerts to respond to potential risks promptly. Through the application of X-Ray, financial institutions can more accurately assess counterparty credit, reduce credit risks, and enhance the reliability and efficiency of decision-making.

Conclusion

X-Ray, as an advanced data decision-making tool, demonstrates immense value and advantages in the financial industry’s application cases. From stock trading strategies and risk management to compliance supervision and counterparty credit assessment, X-Ray enhances decision-making accuracy, efficiency, and risk control capabilities in financial institutions. Through the application of X-Ray, financial institutions can leverage data-driven decision-making processes to improve decision quality and efficiency, bringing about better risk management and compliance supervision results.