In the energy trading industry, as business forms such as crude oil, refined oil, natural gas, and chemical products become increasingly diversified, inventory management is facing complex challenges. A mix of various inbound/outbound methods, cost calculation models, and quality standards has led to highly customized and rule-intensive inventory operations.

This article takes a petroleum trading enterprise as an example, focusing on five core pain points in inventory management within the energy sector. It examines how the Fusion CTRM/ETRM system reshapes inventory management through end-to-end coordination, differentiated configuration, and risk visualization, enabling enterprises to shift from “material management” to digitalized asset management.

I. Inventory Management Pain Points in the Energy Trading Sector

The complexity of energy inventory management does not stem from technology itself, but from diverse business scenarios, conflicting management rules, and inconsistent data practices. Five major challenges stand out:

1. Diverse Business Models Lead to Highly Customized Inventory Management

In oil trading, multiple business models exist such as crude oil and refined products, each with unique inventory logic:

- Different inbound/outbound methods: full-in full-out, full-in partial-out, batch-based outflows, etc.

- Blending behavior varies: some products are blended frequently, others kept pure.

- Cost calculations differ: FIFO, LIFO, moving weighted average, and more.

- Quality standards vary: density, sulfur content, temperature conversion differ across products.

- Inventory valuation methods diverge: different practices in combining physical and paper positions, and reference prices.

The core issue: enterprises often run multiple business types in parallel. The coexistence of various rules makes unified management extremely difficult. However, it’s the detailed logic that determines inventory accuracy and operational efficiency.

2. Inventory Rules Must Satisfy Business, Risk, and Finance Simultaneously

Inventory management isn’t just for operational execution. It also supports multiple departments:

- Finance needs inventory costing to comply with accounting standards.

- Risk management tracks market exposures and unrealized P&L.

- Business needs flexible sourcing and fast contract fulfillment.

The pain point: different departments interpret and manage inventory differently. Without a system that enables multi-dimensional accounting and reconciliation, the result is “one inventory, many versions, conflicting data”.

3. Lack of Execution and Transfer Tracking Undermines Contract Fulfillment and Risk Control

Inventory is not static. It’s part of a dynamic flow:

- Each stage—receipt, stocktaking, transfer, blending—should be clearly recorded.

- Without visibility into material movement, trade matching becomes error-prone.

- Disconnect between warehouse operations and contract execution causes delays, failed deliveries, and double-counting.

- Poor binding between inventory and trades skews exposure calculations, affecting risk assessments.

Fundamentally, this reflects a breakdown in the closed loop between trading, execution, and inventory. Without dynamic matching, there can be no visibility, control, or verification from a trade-centric perspective.

4. Heavy Reliance on Manual Input Leads to Poor Data and High Costs

Manual inventory tracking is still widespread, leading to:

- Incomplete entries—key data like quantity, quality, and ownership are often delayed or inaccurate.

- Lack of standardization and traceability in operations.

- Mismatched records and outdated reports limit effective decision-making.

This highlights the need for automated data collection, calculation, recording, and synchronization, to improve data quality and reduce operational risks.

5. Poor Inventory Holding Control Leads to Dual Exposure: Performance & Market Risk

Inventory is both an asset and a liability:

- Too little inventory jeopardizes timely delivery or pickup, affecting credibility.

- Too much inventory exposes the business to price volatility, increasing mark-to-market losses.

At its core, inventory has become part of the enterprise risk portfolio, not just a logistical record.

To tackle these issues, enterprises urgently need a platform that connects the entire inventory management chain, supports multiple business logics, and enhances risk coordination.

Fusion is built around the complex realities of physical energy trading. It provides a comprehensive inventory management solution tailored to end-to-end processes and diverse business requirements, helping enterprises shift from reactive coping to proactive control.

II. Fusion Inventory Management: An Integrated Solution for the Full Lifecycle of Physical Commodities

The Fusion inventory management solution is designed with “integrated inventory operations” as its core concept. It seamlessly connects key processes from trading to execution, warehousing to risk control, creating a full-lifecycle inventory management platform tailored to physical commodities. The system also provides differentiated, modular management capabilities for various business types. The solution includes the following components:

1. Contract Management for Petroleum and Other Inventory

Fusion supports systematic management of inventory-related contracts, such as tank leasing contracts for petroleum and other businesses. This includes:

- Tank lease contract registration: Recording key information such as contract terms, lease period, tank type, and depot location.

- Logical tank setup: Decoupling physical tanks from goods management, enabling refined ownership and business-level control.

- Tank rental rates and fee management: Managing various charges such as heating fees; all tank-related inventory expenses are integrated for simplified inventory cost settlement.

- Multi-business inventory contract management: Tracking inventory contract numbers, ownership, and contract volumes, laying the groundwork for compliant inventory control.

-1-1024x522.png)

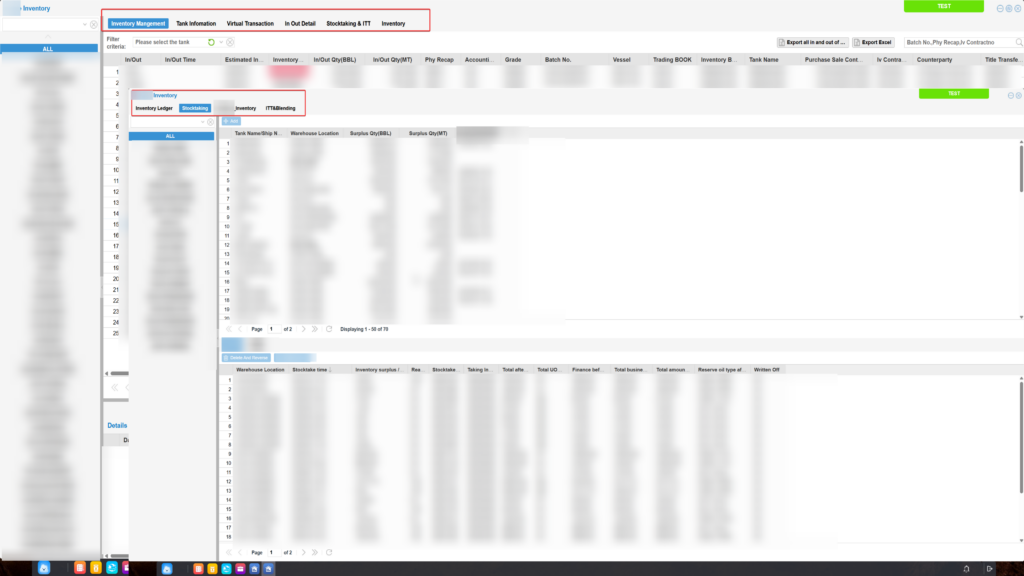

2. End-to-End Execution Management: Improving Inventory Transparency and Compliance

Fusion establishes a comprehensive execution management framework around core inventory processes such as inbound/outbound, stocktaking, and transfers to enhance transparency and compliance:

- Detailed records of inventory depot location, product type, quantity and quality metrics, and pricing. The system auto-generates or calculates some data to reduce manual entry and improve data accuracy.

- Multi-dimensional display of inventory status across trading, execution, risk, stocktaking, and transfers. Inventory statuses are shown in trading, execution, risk management portfolios, and inventory modules.

- Multi-angle tracing of inventory flow states. For instance, the business inventory module consolidates and displays all relationships and flow statuses, including inbound/outbound, stocktaking, transfers, and matching.

This enables both static recording and dynamic inventory tracking. The system integrates all mapping relationships and flow paths, ensuring full traceability of execution processes.

At the same time, the system supports a dedicated business inventory management module that addresses the different flow paths and control requirements of each business type. This meets the needs of personalized inventory control while also integrating shared processes and logic across business lines.

It ensures clear and orderly inventory flow within business units and enables easy tracking of cross-business inventory movements. As a result, complex physical inventory operations become more controllable and traceable within the system.

3. Dynamic Inventory Linkage: Connecting the Business Chain and Enhancing Coordination

Fusion enables real-time information linkage and updates between inventory and other modules—trading, execution, logistics, and risk control—to enhance coordinated management:

- Cross-departmental data consistency: Ensures a unified view of inventory information across trading, logistics, risk control, and settlement roles.

- Instant change synchronization: Automatically updates related modules when inventory statuses change, avoiding information silos.

This mechanism reduces operational errors and risk blind spots caused by inconsistent data. It is a key capability for maintaining stable inventory control under high-frequency operations.

4. Inventory Cost Accounting: Supporting Financial Reconciliation for Diverse Businesses

Fusion supports mainstream inventory cost calculation methods such as FIFO and moving weighted average. It allows users to match the appropriate cost algorithm based on business characteristics and management needs. Customized cost reports can be generated to suit varying inventory cost management requirements across businesses while complying with financial accounting standards.

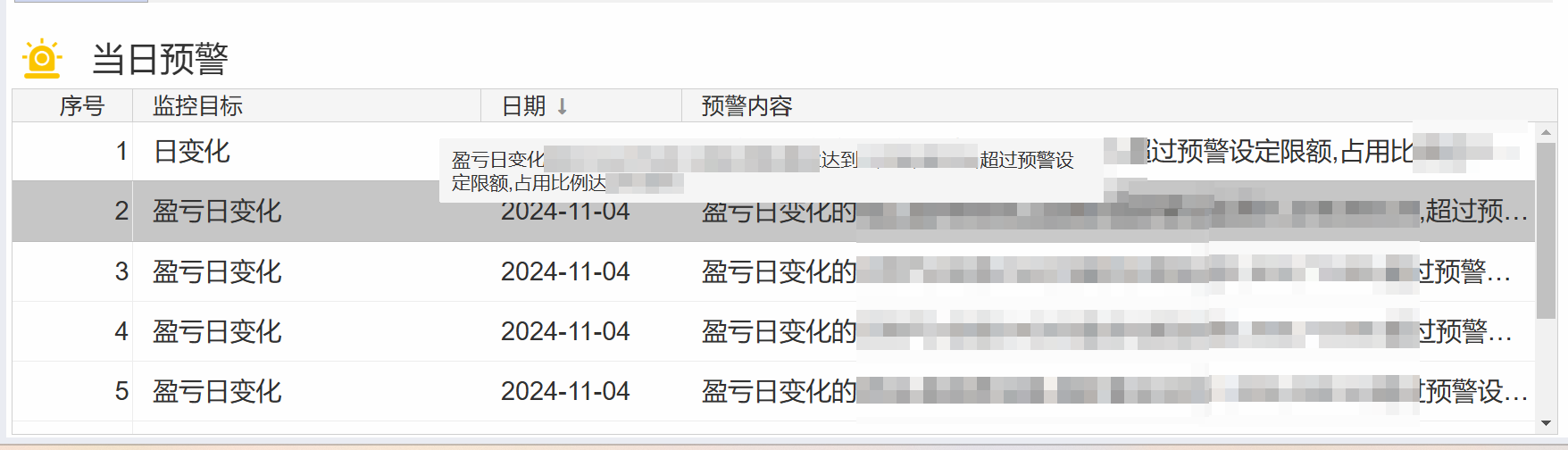

5. Inventory Mark-to-Market and Risk Management: Visualizing Value and Controlling Risk

Fusion supports inventory mark-to-market (MtM) management by investment portfolio (BOOK), integrating physical inventory with futures hedging for a unified risk perspective:

- Inventory MtM valuation: Allows user-defined mark-to-market formulas to calculate inventory value based on market prices.

- Physical/futures exposure hedging: Dynamically calculates net exposure and floating P&L of combined physical and paper positions at the BOOK level.

- Direct P&L visualization: Helps enterprises assess hedge effectiveness and inventory P&L status in real time to support risk decisions.

This capability transforms inventory management from traditional warehousing to financial asset management. Inventory becomes not only controllable but also observable with risk transparency.

In summary, Fusion’s inventory management solution treats inventory as the core node linking trading, execution, risk, and financial operations. It enables the transformation of physical inventory from “logistics control” to “digital asset management.” Through integrated and differentiated management, Fusion effectively helps energy trading enterprises improve inventory efficiency, strengthen risk control, and optimize cost management.

Next, we will use the case of petroleum trading company H to demonstrate how Fusion’s inventory management solution addresses the core pain points of inventory management in the energy sector.

Ⅲ. Fusion Inventory Management in Practice: H Company’s Multi-Business Inventory Solution

When facing the above inventory management challenges in the energy sector, the Fusion system does not adopt a “one-size-fits-all” template. Instead, it uses a modular architecture and flexible rule engine to reassemble capabilities such as contract management, inventory execution, cost control, risk management, and data integration. This approach builds a tailored inventory management solution that balances standardization and differentiation.

This section focuses on how Fusion addresses the inventory challenges faced by petroleum trader H Company across product lines like refined oil and crude oil. We will explain, from both functional and practical perspectives, how the system provides targeted solutions—highlighting its systematic design and real-world effectiveness in handling H Company’s complex inventory scenarios.

Pain Point 1: Wide Variation in Business Models Leads to Highly Customized Inventory Management

System Capabilities: Full Inventory Lifecycle Management, Logical Tank Mechanism

Fusion accounts for the actual differences between crude oil and refined oil operations. It offers a configurable inventory management module that retains common process standards while supporting product-specific customizations. The system decouples goods from physical storage through a “logical tank” mechanism, allowing multiple oil types to coexist and be managed independently within the same system. This enhances adaptability and operational flexibility.

Result:

A unified platform supports multiple business inventory workflows, overcoming the limitation of a single system being unable to handle diverse business models. It improves both standardization and applicability in inventory management.

-1-1024x522.png)

Pain Point 2: Inventory Rules Must Meet Business, Risk, and Finance Requirements

System Capabilities: Dynamic Inventory Integration, Cost Accounting, Inventory Mark-to-Market and Risk Management

Inventory is no longer just a business-side module. It must also support risk exposure management and financial cost control. Fusion links inventory status across trading, logistics, risk, and settlement modules. This ensures full data synchronization and consistency. It supports mainstream accounting methods like FIFO and moving average to meet compliance requirements. In the portfolio module, inventory is tied to the BOOK structure to enable mark-to-market, P&L calculation, and risk analysis.

Result:

Inventory becomes a critical data hub. It bridges various accounting standards and effectively resolves reconciliation issues caused by inconsistent data definitions.

Pain Point 3: Lack of Inventory Execution and Flow Control Affects Performance and Risk Accuracy

System Capabilities: Full Inventory Lifecycle Management, Dynamic Inventory Integration

Fusion supports end-to-end operations for inbound/outbound inventory, stocktaking, transfer, blending, and more. All actions are traceable, ensuring that inventory status aligns with contracts and delivery plans. Inventory is linked to outbound plans and contract performance paths, creating a closed-loop process between inventory and trade execution.

Result:

Inventory management evolves from a “static ledger” to a “dynamic performance platform.” This improves delivery accuracy and reduces blind spots and resource conflicts in physical fulfillment.

Pain Point 4: Manual Data Management Leads to Poor Quality and High Operating Costs

System Capabilities: Full Inventory Lifecycle Management, Dynamic Inventory Integration

The system can automatically calculate and update inventory data, significantly reducing manual input. All changes are synchronized across modules and leave traceable records. Inventory reports are auto-generated, meeting diverse analytical needs of management.

Result:

Automation and standardization of data management are significantly improved. Inventory information becomes more timely and accurate, enhancing operational precision and transparency.

Pain Point 5: Lack of Inventory Holding Control Leads to Both Performance and Market Risk

System Capabilities: Inventory Mark-to-Market and Risk Management

The system values inventory assets using real-time market prices and calculates exposure alongside futures positions at the BOOK level. Dynamic P&L analysis guides inventory structure optimization and position decisions, turning inventory from a resource into a financial asset.

Result:

Risk management transitions from post-event analysis to real-time tracking. This improves the company’s responsiveness to market fluctuations and strengthens risk management.

Overall Implementation Results

Fusion’s inventory solution has been successfully implemented at H Company and other petroleum enterprises, significantly alleviating traditional issues in multi-business coordination, data credibility, execution efficiency, and risk control. It has delivered systemic benefits:

- Over 95% adaptability across business scenarios, supporting various inventory models for crude and refined oil. This greatly enhances unified system management.

- Over 80% reduction in data reconciliation discrepancies between inventory and trading/finance modules, effectively solving data synchronization issues across modules.

- Over 70% automation rate for real-time inventory data processing, significantly reducing manual entry and errors.

- 3x faster response time for inventory-related execution operations, greatly enhancing coordination between contract performance and inventory control.

- 90% coverage for real-time mark-to-market and P&L analysis, achieving full implementation of inventory as a financial asset and risk visibility.

Through these outcomes, Fusion not only builds a unified foundation for inventory management but also transforms it into a powerful tool for operational execution and risk control. This provides a solid digital base for high-quality growth in the oil trading sector.

Conclusion: Building Future-Oriented Smart Inventory Management

The nature of inventory management in oil and energy has evolved. It is no longer merely about storage control, but now supports trade fulfillment and risk asset management.

Fusion builds an inventory system that is transparent, connected, and calculable. Inventory is no longer an isolated module—it becomes a central hub linking trading, finance, and risk.

In volatile market environments, this approach will greatly improve operational efficiency, performance reliability, and risk responsiveness, creating long-term competitive advantages for energy trading companies.

10 Responses

Excellent post. I will be experiencing many of these issues as well..

Also visit my web blog … place the insertion point in the blank paragraph

Thank you for your attention.

You’ve made some good points there. I looked on the internet for more information about

the issue and found most individuals will go along with your views on this site.

Thank you for your attention.

Thank you, I’ve recently been looking for info about this topic for ages and yours is the best I have discovered till now. But, what about the bottom line? Are you sure about the source?

Thank you for your attention! May I ask which part of the article interests you? Are you from a related industry? If you can provide me with more information, I can offer you more professional answers.

whoah this blog is magnificent i love reading your articles. Keep up the good work! You know, lots of people are hunting around for this information, you can help them greatly.

Thank you for your attention! May I ask which part of the article interests you? Are you from a related industry? If you can provide me with more information, I can offer you more professional answers

Pretty great post. I simply stumbled upon your weblog and wanted to mention that I’ve really loved surfing around your weblog posts. In any case I’ll be subscribing to your rss feed and I am hoping you write again soon!

Thank you for your attention! May I ask which part of the article interests you? Are you from a related industry? If you can provide me with more information, I can offer you more professional answers